Mathematics, 01.10.2019 08:00 CoolxBreeze

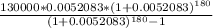

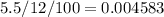

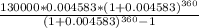

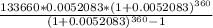

Giselle wants to buy a condo that has a purchase price of $163,000. giselle earns $2,986 a month and wants to spend no more than 25% of her income on her mortgage payment. she has saved up $33,000 for a down payment. giselle is considering the following loan option: 20% down, 30 year at a fixed rate of 6.25%. what modification can be made to this loan to make it a viable option, given giselle’s situation?

a.

change to a 15 year fixed loan

b.

change the interest to 5.5%

c.

change the down payment to 18% down

d.

none. this is a viable option for giselle.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:30

There is diarrhea on the floor. what do i do? my mum gonna see that i diarrhea on the floor! * don't report, i'm serious! *

Answers: 1

Mathematics, 21.06.2019 21:40

The graph of f(x) = |x| is transformed to g(x) = |x + 11| - 7. on which interval is the function decreasing?

Answers: 3

You know the right answer?

Giselle wants to buy a condo that has a purchase price of $163,000. giselle earns $2,986 a month and...

Questions

Business, 25.03.2020 23:02

Mathematics, 25.03.2020 23:02

Mathematics, 25.03.2020 23:02

Mathematics, 25.03.2020 23:02

English, 25.03.2020 23:02

English, 25.03.2020 23:02

English, 25.03.2020 23:02

Mathematics, 25.03.2020 23:03

dollars.

dollars. dollars

dollars

and rest values will be same.

and rest values will be same.