Mathematics, 31.03.2021 21:10 ckolliegbo

Alex is a single taxpayer with $80,000 in taxable income. His investment income consists of $500 of qualified dividends and short-term capital

gains of $2,000.

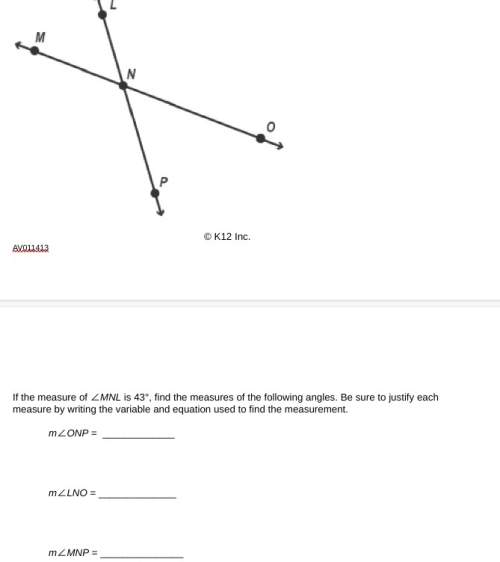

Use the tables to complete the statement.

Single Taxpayers: Income Brackets

Tax Rate Income Bracket

1096

O to 9,525

Single Taxpayers: Qualified

Dividends and Long-Term

Capital Gains

Tax Rate Income Bracket

1296

9,526 to 38,700

38,701 to 82,500

2296

0%

0 to 38,600

2496

82,501 to 157,500

15%

38,601 to 425,800

3296

157,501 to 200,000

2096

> 425,800

3596

200,001 to 500,000

> 500,000

37%

Alex will owe $

in taxes on his investment income.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:00

If x = ∛200, which of the following inequalities is true? * 2 < x < 4 3 < x < 5 6 < x < 6.5 4.5 < x < 5.5 5 < x < 6

Answers: 1

Mathematics, 21.06.2019 15:00

Answer this question only if you know the 30 points and

Answers: 1

Mathematics, 21.06.2019 15:20

Use the x-intercept method to find all real solutions of the equation. -9x^3-7x^2-96x+36=3x^3+x^2-3x+8

Answers: 1

You know the right answer?

Alex is a single taxpayer with $80,000 in taxable income. His investment income consists of $500 of...

Questions

Spanish, 18.10.2020 06:01

Mathematics, 18.10.2020 06:01

Mathematics, 18.10.2020 06:01

Mathematics, 18.10.2020 06:01

History, 18.10.2020 06:01

Mathematics, 18.10.2020 06:01

Mathematics, 18.10.2020 06:01

English, 18.10.2020 06:01

Mathematics, 18.10.2020 06:01