Mathematics, 30.03.2021 23:50 bbrogle5154

The IRS wants to develop a method for detecting whether or not individuals have overstated their deductions for charitable contributions on their tax returns. To assist in this effort, the IRS supplied data found in the file IRS. xlsx that accompanies this book listing the adjusted gross income (AGI) and charitable contributions for 11 taxpayers whose returns were audited and found to be correct.

Required:

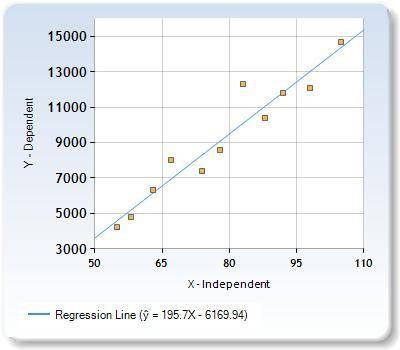

a. Prepare a scatter plot of the data. Does there appear to be a linear relationship between these variables?

b. Develop a simple linear regression model that can be used to predict the level of charitable contributions from a return's AGI. What is the estimated regression equation?

c. Interpret the value of R2.

d. How might the IRS use the regression results to identify returns with unusually high charitable contributions?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:30

What is the order of magnitude for the number of liters in a large bottle of soda served at a party

Answers: 2

Mathematics, 21.06.2019 18:30

Write an inequality and solve each problem.for exercises 11 and 12, interpret the solution.

Answers: 1

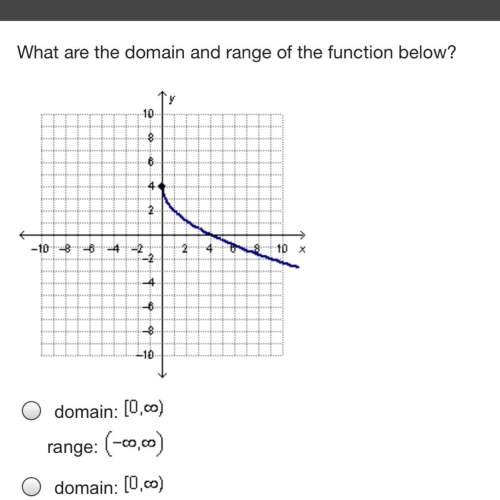

Mathematics, 21.06.2019 19:00

What are the solutions of the equation? 5z^2 + 9z - 2 = 0 a. 1, -2 b. 1, 2 c. 1/5, -2 d. 1/5, 2

Answers: 2

Mathematics, 21.06.2019 20:00

Given ab and cb are tangents of p, and m =10°. what is the measure of abp?

Answers: 3

You know the right answer?

The IRS wants to develop a method for detecting whether or not individuals have overstated their ded...

Questions

Law, 24.04.2020 21:27

Social Studies, 24.04.2020 21:27

Mathematics, 24.04.2020 21:27

History, 24.04.2020 21:27

History, 24.04.2020 21:27

Mathematics, 24.04.2020 21:27