Mathematics, 30.03.2021 01:00 JasJackson

Tax Schedule

The piecewise function below models a portion of the tax brackets for a particular State.

Let x be the amount of taxable income.

0.15x 2,917.50 + 0.20(x - 20,000) f(x) = 8,917.50 + 0.25(x - 50,000)

21,417.50 + 0.30( x- 100,000)

0 ≤ x ≤ 20,000 20,000 < x ≤ 50,000

50,000 < x ≤ 100,000 x > 100,000

Determine the tax for a person with taxable income of $82,450.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:00

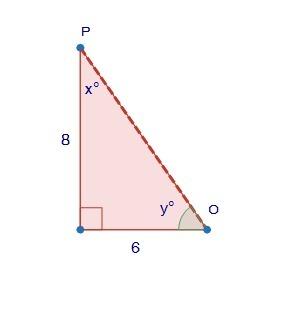

In the 30-60-90 triangle below side s has a length of and side r has a length

Answers: 2

You know the right answer?

Tax Schedule

The piecewise function below models a portion of the tax brackets for a particular Sta...

Questions

History, 28.05.2021 14:00

Mathematics, 28.05.2021 14:00

Physics, 28.05.2021 14:00

History, 28.05.2021 14:00

English, 28.05.2021 14:00

Biology, 28.05.2021 14:00

Physics, 28.05.2021 14:00

Mathematics, 28.05.2021 14:00

Mathematics, 28.05.2021 14:00

Mathematics, 28.05.2021 14:00

Chemistry, 28.05.2021 14:00

Chemistry, 28.05.2021 14:00