Mathematics, 09.03.2021 20:30 aalyyy

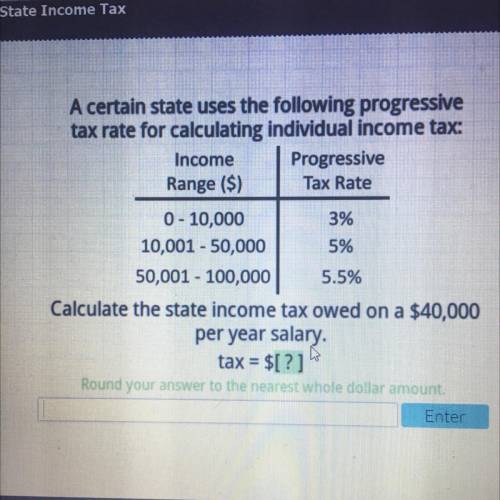

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount,

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Kai walked one and two-thirds of a mile on saturday and four and one-sixth of a mile on sunday. how many miles did kai walk?

Answers: 1

Mathematics, 22.06.2019 02:00

Look at the example below which shows how the product property of radicals is used to simplify a radical. use the product property of radicals to simplify the following radical.

Answers: 3

Mathematics, 22.06.2019 06:30

The price of a box of 15 cloud markers is $12.70. the price of a box of 42 cloud markers is $31.60. all prices are without tax, and the price of the packaging is the same for any size. how much would 50 cloud markers in a box cost? write an equation which will tell the price p for the number n markers in the box.

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Social Studies, 30.10.2020 21:50

Advanced Placement (AP), 30.10.2020 21:50

Mathematics, 30.10.2020 21:50

Computers and Technology, 30.10.2020 21:50

Biology, 30.10.2020 21:50

Mathematics, 30.10.2020 21:50

English, 30.10.2020 21:50

Mathematics, 30.10.2020 21:50

Health, 30.10.2020 21:50

English, 30.10.2020 21:50

Mathematics, 30.10.2020 21:50

English, 30.10.2020 21:50

Mathematics, 30.10.2020 21:50