Mathematics, 08.03.2021 07:10 kingbot350

A $1,000 bond has a coupon of 8 percent and matures after twelve years. Assume that the bond pays interest annually.

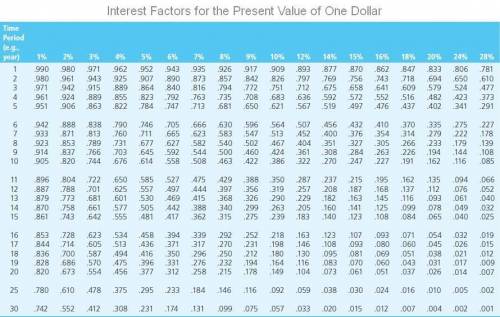

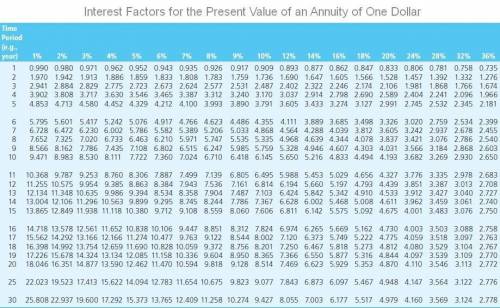

What would be the bond's price if comparable debt yields 10 percent? Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar.

$

What would be the price if comparable debt yields 10 percent and the bond matures after six years? Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar.

$

Why are the prices different in a and b?

The price of the bond in a is

less

than the price of the bond in b as the principal payment of the bond in a is

further out

than the principal payment of the bond in b (in time).

What are the current yields and the yields to maturity in a and b? Round your answers to two decimal places.

The bond matures after twelve years:

CY:

%

YTM:

%

The bond matures after six years:

CY:

%

YTM:

%

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:40

Molly shared a spool of ribbon with 12 people. each person received 3 feet of ribbon. which equation can she use to find r, the number of feet of ribbon that her spool originally had?

Answers: 1

You know the right answer?

A $1,000 bond has a coupon of 8 percent and matures after twelve years. Assume that the bond pays in...

Questions

Mathematics, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

Biology, 20.03.2021 23:10

Physics, 20.03.2021 23:10

Social Studies, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

Biology, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

English, 20.03.2021 23:10

Mathematics, 20.03.2021 23:10

Biology, 20.03.2021 23:10