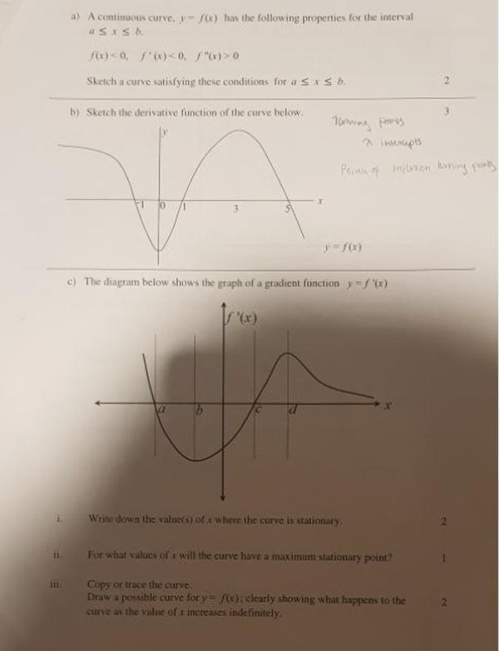

Mathematics, 05.03.2021 19:30 janeekajones08

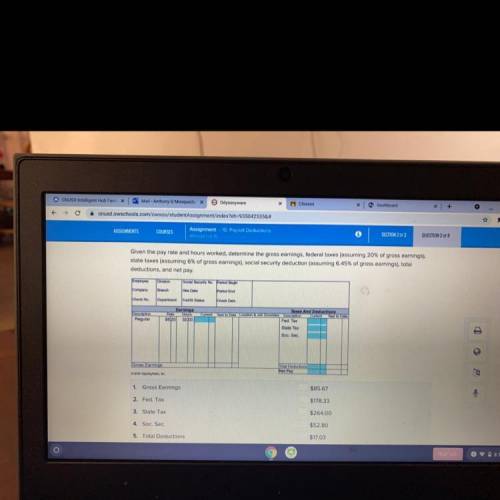

Given the pay rate and hours worked, determine the gross earnings, federal taxes (assuming 20% of gross earnings),

state taxes (assuming 6% of gross earnings), social security deduction (assuming 6.45% of gross earnings), total

deductions, and net pay.

Employee

Division

Social Security No. Perod Bogin

Company

Branch

Hire Date

Period End

Check No

Department Fed St Status

Check Date

Earnings

Rate

$8.25 32.00

HOUS

Cunun

Descnption

Regular

Year to Date

Taxes And Deductions

Location & Job Overdes Description Curend Year to Date

Fed. Tax

State Tax

Soc. Sec

Gross Earnings

Total Deductions

Net Pay

2000

Our

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

The volume of a cube is 8 in to the 3rd power. how long is each side?

Answers: 1

Mathematics, 21.06.2019 17:30

(least common multiples) the answer that i had in the 1st step was lcm of airline tickets sold=72. idk if that even matters but just in case. ! three co-workers are busy selling airline tickets over the phone. in an 8-hour day, charles can sell 8 airline tickets, ann can sell 9 airline tickets, and michelle can sell 6 airline tickets. step 2 of 2: what is the smallest number of 8-hour days needed for each of them to achieve the same number of sales? it takes charles . it takes . it takes .

Answers: 1

Mathematics, 21.06.2019 19:50

What is the solution to the equation below? 3/x-2+6=square root x-2 +8

Answers: 1

Mathematics, 22.06.2019 01:00

Use the drop-down menus to complete the statements to match the information shown by the graph.

Answers: 3

You know the right answer?

Given the pay rate and hours worked, determine the gross earnings, federal taxes (assuming 20% of gr...

Questions

Mathematics, 09.04.2020 23:59

Mathematics, 09.04.2020 23:59

Spanish, 09.04.2020 23:59

Mathematics, 09.04.2020 23:59

English, 09.04.2020 23:59

English, 10.04.2020 00:14