Mathematics, 01.03.2021 18:30 genyjoannerubiera

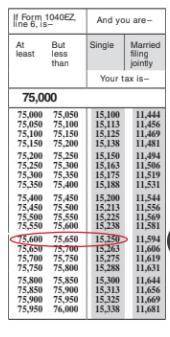

Katrina is single with a taxable income for last year of $75,431. Her

employer withheld $14,870 in federal taxes.

a. Use the tax table below to determine the amount of taxes that Katrina owes (ignore what is circled when trying to answer the question)

b. Does Katrina get a refund? Or does Katrina owe the IRS?

c. Find the difference between Katrina’s tax and the amount with-

held by her employer.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 19:00

The fence around a quadrilateral-shaped pasture is 3a^2+15a+9 long. three sides of the fence have the following lengths: 5a, 10a-2, a^2-7. what is the length of the fourth side of the fence?

Answers: 1

Mathematics, 21.06.2019 21:00

Circle d circumscribes abc and abe. which statements about the triangles are true? statement i: the perpendicular bisectors of abc intersect at the same point as those of abe. statement ii: the distance from c to d is the same as the distance from d to e. statement iii: bisects cde. statement iv: the angle bisectors of abc intersect at the same point as those of abe. a. i only b. i and ii c. ii and iv d. i and iii e. iii and iv

Answers: 2

Mathematics, 21.06.2019 22:00

To decrease an amount by 16% what single multiplier would you use

Answers: 1

Mathematics, 22.06.2019 01:30

Two numbers have a sum of 93. if one number is p, express the other number in terms of p.

Answers: 1

You know the right answer?

Katrina is single with a taxable income for last year of $75,431. Her

employer withheld $14,870 in...

Questions

Mathematics, 19.03.2021 01:00

Mathematics, 19.03.2021 01:00

English, 19.03.2021 01:00

Mathematics, 19.03.2021 01:00

Mathematics, 19.03.2021 01:00

Mathematics, 19.03.2021 01:00