Mathematics, 18.02.2021 20:10 leo4687

A certain state uses the following progressive tax rate for calculating individual income tax: Income Progressive Range ($) Tax Rate 0 - 10,000 3% 10,001 - 50,000 5% 50,001 - 100,000 5.5% Calculate the state income tax owed on a $70,000 per year salary. tax = $[?] Round your answer to the nearest whole dollar amount. Enter

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

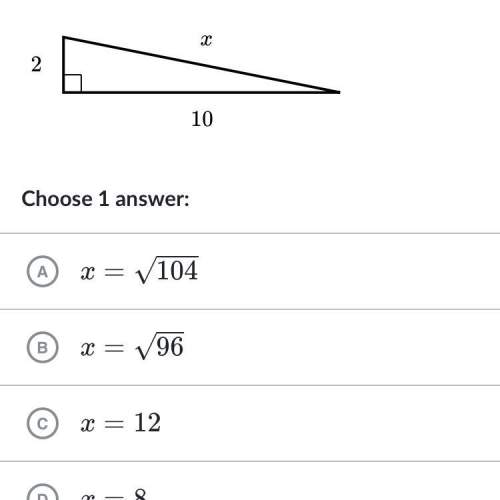

For the quadratic function [tex]y=(x+4)^2-1[/tex] , do the following: a) rewrite the function in the standard form, b) rewrite the function in intercept form, c) find the vertex, d) find the y-intercept, e) find the x-intercepts.

Answers: 1

Mathematics, 21.06.2019 22:30

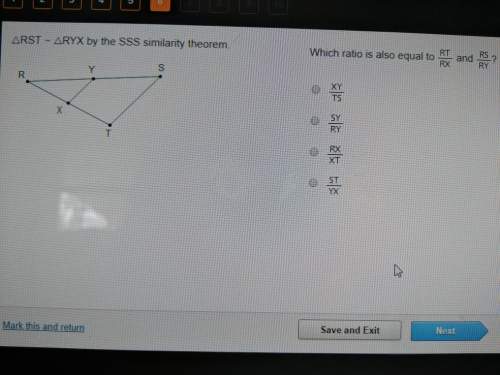

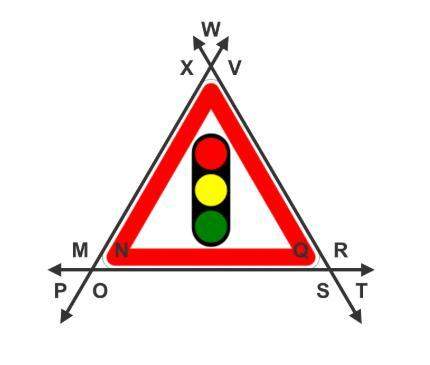

Which statements are true about additional information for proving that the triangles are congruent check all that apply

Answers: 1

You know the right answer?

A certain state uses the following progressive tax rate for calculating individual income tax: Incom...

Questions

Spanish, 18.02.2021 16:20

Biology, 18.02.2021 16:20

Computers and Technology, 18.02.2021 16:20

Chemistry, 18.02.2021 16:20

Engineering, 18.02.2021 16:20

Spanish, 18.02.2021 16:30

Biology, 18.02.2021 16:30

English, 18.02.2021 16:30

Mathematics, 18.02.2021 16:30

Mathematics, 18.02.2021 16:30