Mathematics, 16.02.2021 01:50 dnarioproctor

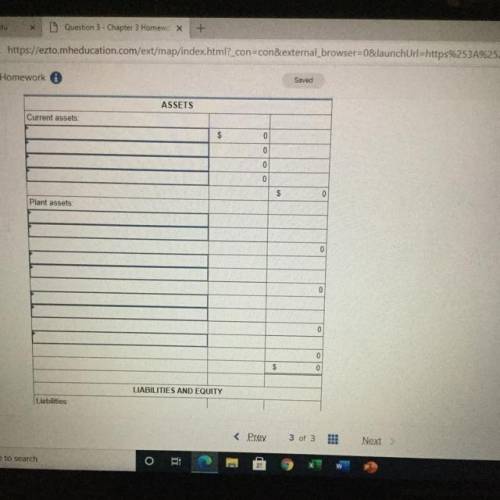

Than Nguyen opened a business called Nguyen engineering and recorded the following transactions in its first month of operations.

June 1: Than Nguyen, the owner, invested $158,000 cash, office equipment with a value of $19,500, and $89,000 of drafting equipment to launch the company in exchange for common stock.

June 2: the company purchased land worth $63,500 for an office by paying $26,000 cash and signing a long-term note payable for $36,900.

June 2: The company purchased a portable building with $40,500 cash and moved it onto the land acquired on June 2.

June 2: The company paid $11,700 cash for the premium on a 15-month insurance policy.

June 7: The company completed and delivered a set of plans for a client and collected $17,800 cash.

June 12: The company purchased $37,400 of additional drafting equipment by paying $24,000 cash and signing a long-term note payable for $13,400.

June 14: The company completed $37,200 of engineering services for a client. This amount is to be received in 30 days.

June 15: The company purchased $2,600 of additional office equipment on credit.

June 17: The company completed engineering services for $27,000 on credit.

June 18: The company revived a bill for rent of equipment that was used on a recently completed job. The $2,750 rent cost must be paid within 30 days.

June 20: The company collected $18,600 cash in partial payment from the client billed on June 14.

June 21: The company paid $2,000 cash for wages to a drafting assistant.

June 23: The company paid $2,600 cash to settle the account payable created on June 15.

June 24: The company paid $1,650 for minor maintenance of its drafting equipment.

June 26: The company paid $10,060 cash in dividends.

June 28: The company paid $2,000 cash for wages to a drafting assistant.

June 30: The company paid $3,660 cash for advertisements on the web during June.

Description of items that require adjusting entries on June 30, follow:

A.) The company has completed, but not yet billed, $17,600 of engineering services for a client.

B.) straight-line depreciation on the office equipment, assuming a 5 year life and a $2,300 salvage value, is $330 per month.

C.) straight-line depreciation on the drafting equipment, assuming a 5 year life and a $12,400 salvage value, is $1,900 per month.

D.) straight-line depreciation on the building, assuming a 25 year life and a $1,500 salvage value, is $130 per month.

E.) the balance in prepaid insurance represents a 15 month policy that went into effect on June 1.

F.) Accrued interest on the long-term note payable is $190.

G.) the drafting assistant is paid $2,000 for a 5 day work week. 2 days’ wages have been incurred but are unpaid as of month end.

Please answer and thank you

Part 1

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Bruce is getting materials for a chemistry experiment his teacher gives him a container that has 0.25 liter of liquid in it.bruce need to use 0.4 of this liquid for the experiment. how much liquid will bruce use?

Answers: 3

Mathematics, 21.06.2019 18:00

How much dextrose 70% must be mixed with dextrose 5% to prepare 1,000 ml of dextrose 20%?

Answers: 1

Mathematics, 21.06.2019 20:50

Which of the following pair(s) of circles have las a common external tangent? select all that apply. a and b a and c b and c

Answers: 3

You know the right answer?

Than Nguyen opened a business called Nguyen engineering and recorded the following transactions in i...

Questions

History, 18.10.2020 05:01

English, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

History, 18.10.2020 05:01

Social Studies, 18.10.2020 05:01

English, 18.10.2020 05:01

English, 18.10.2020 05:01

French, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01