Mathematics, 13.02.2021 01:00 Tyrant4life

A pension fund manager decides to invest a total of at most $40 million in U. S. Treasury bonds paying 6% annual interest and in mutual funds paying 8% annual interest. He plans to invest at least 5 million in bonds and at least $5 million in mutual funds. Bonds have an initial fee of $100 per million dollars, while the fee for mutual funds is $200 per million. The fund manager is allowed to spend no more than $7000 on fees. How much should be invested in each to modimile annual

interest? What is the maimum annual interest

the amount that should be invested in treasury bonds is $(?) million and the amount that should be invested in mutual funds is $(?) million

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 22:00

Billie holiday sells children's clothing for sara vaughn's toddler shop. baby blankets sell for $29.99 after a markup rate based on cost of 109%. find the cost and the markup.

Answers: 2

Mathematics, 21.06.2019 22:50

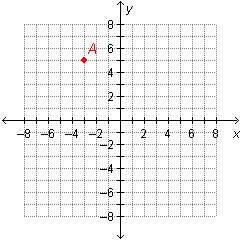

Which statement accurately describes how to perform a 90° clockwise rotation of point a (1,4) around the origin?

Answers: 2

Mathematics, 22.06.2019 02:30

If wxyz is a square, which statements must be true? plz < 3

Answers: 1

You know the right answer?

A pension fund manager decides to invest a total of at most $40 million in U. S. Treasury bonds payi...

Questions

History, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00

Mathematics, 18.05.2021 21:00