Mathematics, 28.01.2021 19:50 sweetmochi13

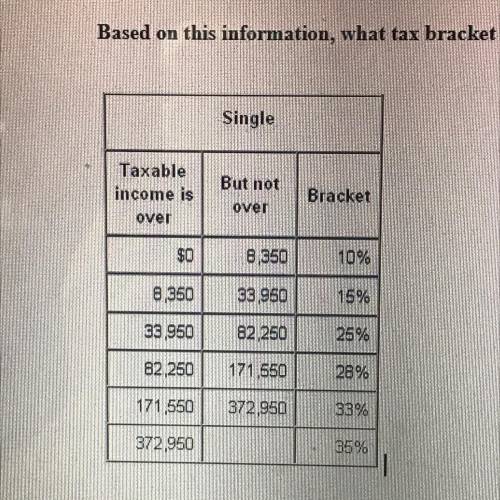

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part time as a medical assistant. Each year she files as Single, takes a standard deduction of $5700 and claims herself as only exemption for $3650. Based on this information, what tax bracket does Monica fall into?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:30

Alcoa was $10.02 a share yesterday. today it is at $9.75 a share. if you own 50 shares, did ou have capital gain or loss ? how much of a gain or loss did you have ? express the capital gain/loss as a percent of the original price

Answers: 2

Mathematics, 21.06.2019 21:50

Free points also plz look my profile and answer really stuff

Answers: 2

Mathematics, 21.06.2019 22:00

Apackage of five erasers cost 0. $.39 at this rate how many how much would 60 erasers cost in dollars and cents

Answers: 2

You know the right answer?

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part...

Questions