Mathematics, 26.01.2021 01:00 eweqwee4163

ANB Leasing is planning to lease an asset costing $210,000. The lease period will be 6 years. At the end of 6 years, the salvage value is estimated to be $30,000. The asset will be depreciated on a straight-line basis of $30,000 per year over the 6-year period. ANB's marginal income tax rate is 40%, but its average tax rate is only 31.5%. Assuming ANB Leasing requires a 12% after-tax rate of return on the lease, determine the required annual beginning of the year lease payments. a. $52,653 b. $45,609 c. $46,120 d. $31,592

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:30

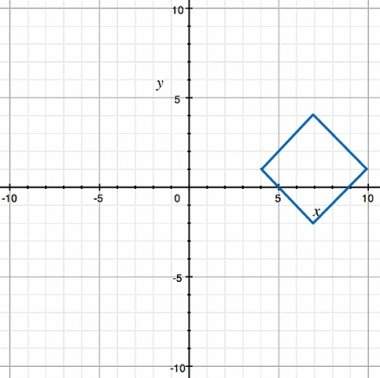

Which point is a solution to the inequality shown in this graph (-3,-3)(3,-1)

Answers: 2

Mathematics, 21.06.2019 17:00

In the given figure ar(adf) =ar(cda) and ar(cdf) = ar(cdf). show that abdc and cdfe are trapeziums.

Answers: 2

Mathematics, 21.06.2019 20:30

On a cm grid, point p has coordinates (3,-1) and point q has coordinates (-5,6) calculate the shortest distance between p and q give your answer to 1 decimal place

Answers: 2

Mathematics, 21.06.2019 22:30

Solve: 25 points find the fifth term of an increasing geometric progression if the first term is equal to 7−3 √5 and each term (starting with the second) is equal to the difference of the term following it and the term preceding it.

Answers: 1

You know the right answer?

ANB Leasing is planning to lease an asset costing $210,000. The lease period will be 6 years. At the...

Questions

Mathematics, 19.05.2020 02:08

Social Studies, 19.05.2020 02:08

Health, 19.05.2020 02:08

English, 19.05.2020 02:08

Biology, 19.05.2020 02:08

History, 19.05.2020 02:08

Mathematics, 19.05.2020 02:08

Chemistry, 19.05.2020 02:08