Mathematics, 14.01.2021 04:00 jazminecousart3

3. Chloe had two jobs. She earned $73,440 working the first 8 months of the year at a nursing home. She switched jobs in September and began to work in a

hospital, where she earned $59,000. The maximum taxable income for Social Security in 2019 was $132,900. The Social Security tax rate was 6.29. How much

OASDI tax (old age, survivors, and disability insurance tax) did Chloe overpay?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:30

The table respent two linear functions the equation respented by the first tables is given

Answers: 2

Mathematics, 21.06.2019 15:30

What is the domain and range of each function 1. x (3, 5, 7, 8, 11) y ( 6, 7, 7, 9, 14) 2. x (-3, -1, 2, 5, 7) y (9, 5, 4, -5, -7)

Answers: 2

Mathematics, 21.06.2019 16:50

The parabola x = y² - 9 opens: a.)up b.)down c.) right d.)left

Answers: 1

Mathematics, 21.06.2019 19:20

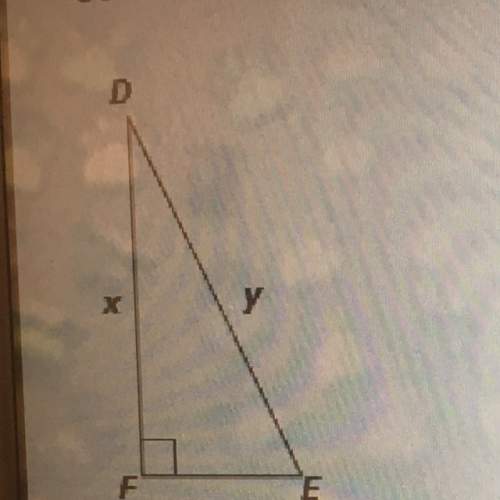

Based on the diagram, match the trigonometric ratios with the corresponding ratios of the sides of the triangle. tiles : cosb sinb tanb sincposs matches: c/b b/a b/c c/a

Answers: 2

You know the right answer?

3. Chloe had two jobs. She earned $73,440 working the first 8 months of the year at a nursing home....

Questions

Mathematics, 31.03.2021 05:50

Chemistry, 31.03.2021 05:50

Mathematics, 31.03.2021 05:50

Spanish, 31.03.2021 05:50

Chemistry, 31.03.2021 05:50

Mathematics, 31.03.2021 05:50

History, 31.03.2021 05:50

History, 31.03.2021 05:50

English, 31.03.2021 05:50