Mathematics, 13.01.2021 19:30 derick263

In 2009, the maximum taxable income for Social Security was $102,000 and the rate was 6.2%. The rate for Medicare tax was 1.45%. If Jessica’s taxable income as an attorney was $152,000 that year, how much did she pay in FICA (Social Security and Medicare) taxes?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:30

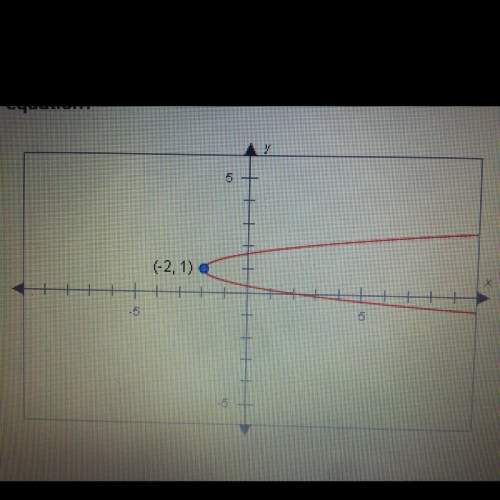

Hardest math question of all time can you solve the equation. check for extraneous solutions.9∣9-8x∣ = 2x+3

Answers: 2

Mathematics, 21.06.2019 20:00

Which fraction is equal to 1hole and 2/5? a.3/5 b.75 c.57 d.73

Answers: 2

Mathematics, 21.06.2019 20:30

Clarence wants to buy a new car. he finds an ad for a car that costs 27,200 dollars. suppose his local sales tax is 7%. -how much would he have to pay? -what is the cost of the car including tax? -if clarence has 29,864 saved, can he pay cash to buy the car?

Answers: 1

Mathematics, 22.06.2019 01:00

Find the rate of change for the situation.you run 7 miles in one hour and 21 miles in three hours.

Answers: 1

You know the right answer?

In 2009, the maximum taxable income for Social Security was $102,000 and the rate was 6.2%. The rate...

Questions

Mathematics, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

Biology, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

Computers and Technology, 22.05.2020 15:57

English, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

Mathematics, 22.05.2020 15:57

History, 22.05.2020 15:57

Biology, 22.05.2020 15:57