Mathematics, 17.12.2020 23:50 trinigal83

Bank of America issues a MBS based on a mortgage pool with the following terms: the mortgage pool face value, $10,000,000; the mortgage interest rate, 5%; the mortgage maturity, 4 years. Suppose the MBS has only one class of security, i. e., this is the basic MBS discussed during the class. The MBS has a 4 year maturity. What is the price of this MBS if the market interest rate is 4.5%? Assume annual compounding is used and the annual prepayment rate is 10%. Also, assume prepayment is paid based on the beginning balance of the mortgage pool each year. Finally, there is a 0.25% servicing fee each year based on the beginning balance of the mortgage pool.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:40

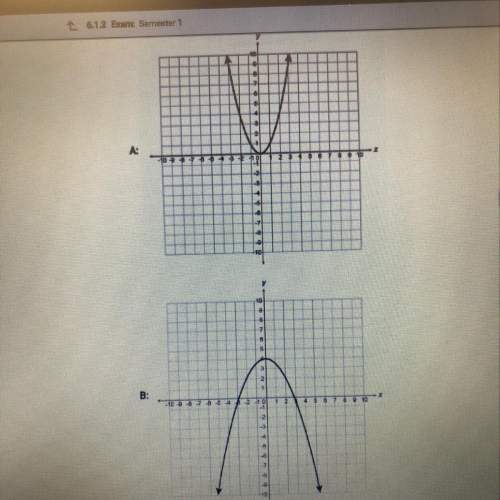

What is the average rate of change for this function for the interval from x=2 to x=4 ?

Answers: 2

Mathematics, 21.06.2019 17:40

Multiply. write your answer in simplest form. 3/8 x 5/7

Answers: 1

Mathematics, 21.06.2019 18:30

Two angles are complementary. the large angle is 36 more than the smaller angle. what is the measure of the large angle?

Answers: 1

Mathematics, 21.06.2019 22:00

Given sin∅ = 1/3 and 0 < ∅ < π/2 ; find tan2∅ a. (4√2)/9 b. 9/7 c. (4√2)/7 d.7/9

Answers: 2

You know the right answer?

Bank of America issues a MBS based on a mortgage pool with the following terms: the mortgage pool fa...

Questions

Mathematics, 01.02.2020 01:03

Mathematics, 01.02.2020 01:03

History, 01.02.2020 01:03

English, 01.02.2020 01:03

History, 01.02.2020 01:03

English, 01.02.2020 01:03

Health, 01.02.2020 01:03

Mathematics, 01.02.2020 01:03

History, 01.02.2020 01:03

Mathematics, 01.02.2020 01:03

Mathematics, 01.02.2020 01:03