Mathematics, 10.11.2020 23:30 10040816

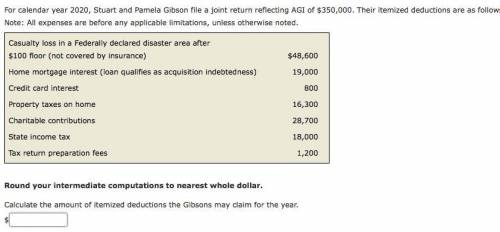

For calendar year 2020, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Note: All expenses are before any applicable limitations, unless otherwise noted.

Casualty loss in a Federally declared disaster area after

$100 floor (not covered by insurance) $48,600

Home mortgage interest (loan qualifies as acquisition indebtedness) 19,000

Credit card interest 800

Property taxes on home 16,300

Charitable contributions 28,700

State income tax 18,000

Tax return preparation fees 1,200

Round your intermediate computations to nearest whole dollar.

Calculate the amount of itemized deductions the Gibsons may claim for the year.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Sarah took the advertising department from her company on a round trip to meet with a potential client. including sarah a total of 11 people took the trip. she was able to purchase coach tickets for $280 and first class tickets for $1280. she used her total budget for airfare for the trip, which was $6080. how many first class tickets did she buy? how many coach tickets did she buy?

Answers: 1

You know the right answer?

For calendar year 2020, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. The...

Questions

Biology, 23.11.2021 03:10

History, 23.11.2021 03:10

English, 23.11.2021 03:10

History, 23.11.2021 03:10

Biology, 23.11.2021 03:10

English, 23.11.2021 03:10

Mathematics, 23.11.2021 03:10

Biology, 23.11.2021 03:10

Mathematics, 23.11.2021 03:10

Mathematics, 23.11.2021 03:10

Mathematics, 23.11.2021 03:10

History, 23.11.2021 03:10

Mathematics, 23.11.2021 03:10

Social Studies, 23.11.2021 03:10

English, 23.11.2021 03:10