Mathematics, 10.11.2020 17:00 malachilaurenc

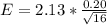

Although the first quarter of 2002 was quite dismal on Wall Street, mutual funds investing in gold companies rose an average of 35.2%. Assume that the distribution of returns in the first quarter of 2002 for mutual funds specializing in gold companies is fairly symmetrical with a mean of 35.2% and a standard deviation of 20%. If random samples of 16 gold stock funds were selected:

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 21:20

Drag each expression to the correct location on the solution. not all expressions will be used. consider the polynomial 8x + 2x2 - 20x - 5. factor by grouping to write the polynomial in factored form.

Answers: 1

Mathematics, 22.06.2019 02:50

Arepresentative from plan 1 wants to use the graph below to sell health plans for his company how might the graph be redrawn to emphasize the difference between the cost per doctor visit for each of the three plans?

Answers: 1

You know the right answer?

Although the first quarter of 2002 was quite dismal on Wall Street, mutual funds investing in gold c...

Questions

Mathematics, 31.01.2020 21:42

Mathematics, 31.01.2020 21:42

Chemistry, 31.01.2020 21:42

Mathematics, 31.01.2020 21:42

Mathematics, 31.01.2020 21:42

Mathematics, 31.01.2020 21:42

at a degree of freedom of

at a degree of freedom of