Mathematics, 05.11.2020 20:30 rayniqueamee2002

Question 2 1 pts Oscar got his first job in 2009. In that year Social Security tax was 6.2% of income up to $106,800. Medicare tax was 1.45%. If Oscar earned $73,232 in 2009. Determine how much he paid for Social Security taxes. Then determine how much he paid in Medicare taxes, and answer the question: What was his total gross Social Security and Medicare tax for the year? Input just the numbers -no dollar sign. D Previous Next >

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:30

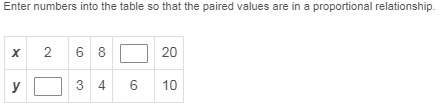

Any is very appreciated! (picture is provided below)not sure how to do this at all won't lie

Answers: 1

Mathematics, 21.06.2019 18:30

Two cyclists 84 miles apart start riding toward each other at the same. one cycles 2 times as fast as the other. if they meet 4 hours later, what is the speed (in mi/h) of the faster cyclist?

Answers: 1

Mathematics, 21.06.2019 18:50

Determine which expressions represent real numbers and which expressions represent complex number. asaaap! plis!

Answers: 1

Mathematics, 21.06.2019 19:30

Agroup of randomly selected apple valley high school students were asked to pick their favorite gym class. the table below shows the results of the survey. there are 528 students at apple valley high school. gym class number of students racquet sports 1 team sports 9 track and field 17 bowling 13 based on the data, what is the most reasonable estimate for the number of students at apple valley high school whose favorite gym class is bowling? choose 1 answer a. 9 b. 13 c. 119 d. 172

Answers: 1

You know the right answer?

Question 2 1 pts Oscar got his first job in 2009. In that year Social Security tax was 6.2% of incom...

Questions

Mathematics, 19.09.2019 15:00

History, 19.09.2019 15:00

Mathematics, 19.09.2019 15:00

Social Studies, 19.09.2019 15:00

Mathematics, 19.09.2019 15:00

Physics, 19.09.2019 15:00

Social Studies, 19.09.2019 15:00

Mathematics, 19.09.2019 15:00

Health, 19.09.2019 15:00

Mathematics, 19.09.2019 15:00

Mathematics, 19.09.2019 15:00

History, 19.09.2019 15:00