Mathematics, 02.11.2020 17:00 applesass

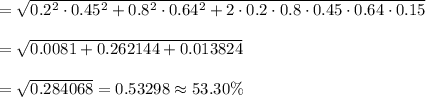

Security F has an expected return of 12.0 percent and a standard deviation of 45.0 percent per year. Security G has an expected return of 17.0 percent and a standard deviation of 64.0 percent per year. a. What is the expected return on a portfolio composed of 20 percent of Security F and 80 percent of Security G? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. If the correlation between the returns of Security F and Security G is .15, what is the standard deviation of the portfolio described in part (a)? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:00

The graph shows the distance y, in inches, a pendulum moves to the right (positive displacement) and to the left (negative displacement), for a given number of seconds x. how many seconds are required for the pendulum to move from its resting position and return? enter your answer in the box.

Answers: 2

Mathematics, 21.06.2019 22:00

The coordinates r(1, -3), s(3, -1) t(5, -7) form what type of polygon? a right triangle an acute triangle an equilateral triangle an obtuse triangle

Answers: 1

Mathematics, 21.06.2019 22:30

5, 6, 10 question: a. determine whether the side lengths form a triangle. (explain your reasoning) b. if it is a triangle, determine whether it is a right, acute, or obtuse triangle. (show your work)

Answers: 1

Mathematics, 21.06.2019 23:50

Use a transformation to solve the equation. w/4 = 8 can you also leave a detailed explanation on how this equation = 32

Answers: 1

You know the right answer?

Security F has an expected return of 12.0 percent and a standard deviation of 45.0 percent per year....

Questions

Mathematics, 14.07.2019 20:00

Health, 14.07.2019 20:00

Health, 14.07.2019 20:00

Mathematics, 14.07.2019 20:00

French, 14.07.2019 20:00

Mathematics, 14.07.2019 20:00

History, 14.07.2019 20:00

Computers and Technology, 14.07.2019 20:00

Mathematics, 14.07.2019 20:00

Chemistry, 14.07.2019 20:00