Mathematics, 27.10.2020 21:10 iiWavyArthur

Select the correct answer from each drop-down menu.

Use the tables to complete the statements.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

Single Taxpayers: Qualified

Dividends and Long-Term

Capital Gains

Tax Rate Income Bracket

12%

9,526 to 38,700

2296

38,701 to 82,500

0%

0 to 38,600

24%

15%

32%

82,501 to 157,500

157,501 to 200,000

200,001 to 500,000

> 500,000

38,601 to 425,800

> 425,800

20%

35%

37%

If she earned

Rita has a taxable income of $85,000. She sold stock after owning it for six months, resulting in a blank

$5,000 on the sale of the stock, Rita must pay $blank in taxes on the gain.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 19:20

Aefg - almn. find the ratio of aefg to almn. a)1: 4 b)1: 2 c)2.1 d)4: 1

Answers: 1

Mathematics, 22.06.2019 01:00

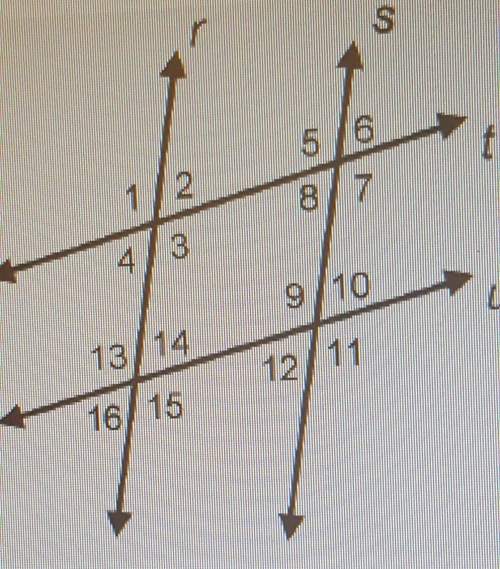

Lines f and g are cut by the transversal d. the measure of 1 = 2x + 35 and the measure of 8 = 10x - 85. what value of x will show that lines f and g are parallel? a. 19 b. 26 c. 18 d. 15

Answers: 1

Mathematics, 22.06.2019 01:00

Acentral angle measuring 160 degrees intercepts an arc in a circle whose radius is 4. what is the length of the arc the circle formed by this central angle? round the length of the arc to the nearest hundredth of a unit. a) 4.19 units b) 6.28 units c) 12.57 units d) 12.57 square units

Answers: 3

You know the right answer?

Select the correct answer from each drop-down menu.

Use the tables to complete the statements.

Questions

Social Studies, 05.07.2019 23:00

Mathematics, 05.07.2019 23:00

Advanced Placement (AP), 05.07.2019 23:00

History, 05.07.2019 23:00

Mathematics, 05.07.2019 23:00

History, 05.07.2019 23:00

History, 05.07.2019 23:00

History, 05.07.2019 23:00