Mathematics, 13.10.2020 04:01 person76

Ms. Benoit is a self-employed architect who earns $300,000 annual taxable income. For the past several years, her tax rate on this income has been 35 percent. Because of recent tax law changes, Ms. Benoit’s tax rate for next year will decrease to 25 percent. Based on a static forecast, how much less revenue will the government collect from Ms. Benoit is a self-employed architect who earns $300,000 annual taxable income. For the past several years, her tax rate on this income has been 35 percent. Because of recent tax law changes, Ms. Benoit’s tax rate for next year will decrease to 25 percent. a) Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year? b) How much less revenue will the government collect from Ms. Benoit next year if she responds to the rate decrease by working more hours and earning $375,000 taxable income? c) How much less revenue will the government collect from Ms. Benoit next year if she responds to the rate decre

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:04

P= $1400,300 r = 7 1/2% t = 4 what is i ? $4.29 $429.00 $4290.00

Answers: 1

Mathematics, 21.06.2019 15:00

What is the compound interest in a three-year, $100,000 loan at a 10 percent annual interest rate a) 10.00 b) 21.00 c) 33.10 d) 46.41

Answers: 1

Mathematics, 22.06.2019 00:30

What is the mean of the data set 125, 141, 213, 155, 281

Answers: 2

Mathematics, 22.06.2019 01:30

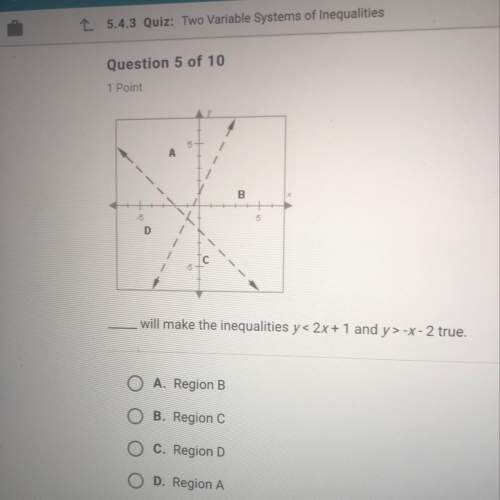

Which shaded region is the solution to the system of inequalities? y y[tex]\geq[/tex]-x+1

Answers: 3

You know the right answer?

Ms. Benoit is a self-employed architect who earns $300,000 annual taxable income. For the past sever...

Questions

Mathematics, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Spanish, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

English, 19.12.2020 01:00

English, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Law, 19.12.2020 01:00

Chemistry, 19.12.2020 01:00

English, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Biology, 19.12.2020 01:00