Mathematics, 06.10.2020 23:01 j015

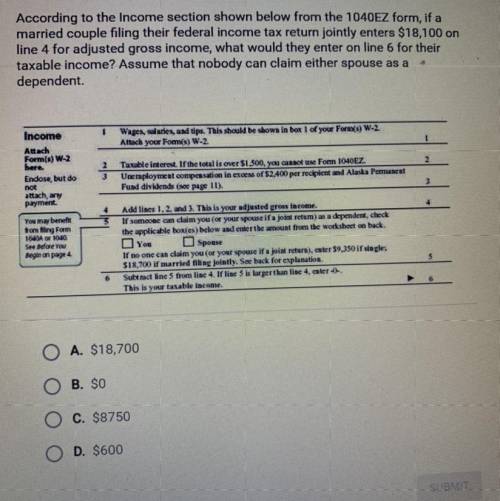

According to the Income section shown below from the 1040EZ form, if a

married couple filing their federal income tax return jointly enters $18,100 on

line 4 for adjusted gross income, what would they enter on line 6 for their

taxable income? Assume that nobody can claim either spouse as a

dependent.

A.18,700

B.0

C.8,750

D.600

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 22:10

Ellen makes and sells bookmarks. she graphs the number of bookmarks sold compared to the total money earned. why is the rate of change for the function graphed to the left?

Answers: 1

Mathematics, 21.06.2019 23:30

Alex's monthly take home pay is $2,500. what is the maximum bad debt payment he can maintain without being in credit overload?

Answers: 2

You know the right answer?

According to the Income section shown below from the 1040EZ form, if a

married couple filing their...

Questions

English, 25.11.2020 01:00

Computers and Technology, 25.11.2020 01:00

History, 25.11.2020 01:00

Mathematics, 25.11.2020 01:00

History, 25.11.2020 01:00

History, 25.11.2020 01:00

Mathematics, 25.11.2020 01:00

Mathematics, 25.11.2020 01:00

Mathematics, 25.11.2020 01:00