Mathematics, 02.10.2020 20:01 jsbdbdkdkkd5104

The Can-Do Co. is analyzing a proposed project with anticipated sales of 12,000 units, give or take 4 percent. The expected variable cost per unit is $7 and the expected fixed cost is $36,000. The cost estimates have a range of plus or minus 6 percent. The depreciation expense is $29,600. The tax rate is 34 percent. The sale price is estimated at $14.99 a unit, give or take 1 percent. What is the operating cash flow under the best-case scenario?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:20

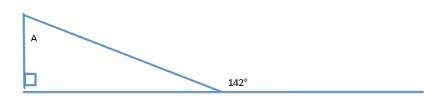

Find the slope of a line given the following two points

Answers: 1

Mathematics, 21.06.2019 20:00

The diagram shows corresponding lengths in two similar figures. find the area of the smaller figure. a. 14.4 yd2 b. 24 yd2 c. 26.4 yd2 d. 28

Answers: 1

Mathematics, 21.06.2019 22:40

Identify this conic section. x2 - y2 = 16 o line circle ellipse parabola hyperbola

Answers: 2

Mathematics, 21.06.2019 23:20

Using only the digits 5, 6, 7, 8, how many different three digit numbers can be formed if no digit is repeated in a number?

Answers: 1

You know the right answer?

The Can-Do Co. is analyzing a proposed project with anticipated sales of 12,000 units, give or take...

Questions

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Social Studies, 08.06.2020 22:57

Chemistry, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Chemistry, 08.06.2020 22:57

History, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57

Mathematics, 08.06.2020 22:57