Mathematics, 05.09.2020 19:01 F00Dislife

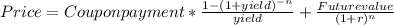

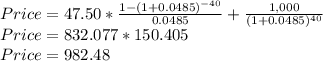

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require an 10.7% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Show your workcan a right triangle have this sides? *how to prove it without using the pythagorean theorema*

Answers: 2

Mathematics, 21.06.2019 22:30

Assume that y varies inversely with x. if y=1.6 when x=0.5 find x when y=3.2 acellus answer

Answers: 2

Mathematics, 22.06.2019 01:10

Given: ae ≅ ce ; de ≅ be prove: abcd is a parallelogram. we have that ab || dc. by a similar argument used to prove that △aeb ≅ △ced, we can show that △ ≅ △ceb by. so, ∠cad ≅ ∠ by cpctc. therefore, ad || bc by the converse of the theorem. since both pair of opposite sides are parallel, quadrilateral abcd is a parallelogram.

Answers: 3

You know the right answer?

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon...

Questions

Business, 23.04.2021 23:20

Mathematics, 23.04.2021 23:20

History, 23.04.2021 23:20

Mathematics, 23.04.2021 23:20

Mathematics, 23.04.2021 23:20

Biology, 23.04.2021 23:20

Mathematics, 23.04.2021 23:20

Mathematics, 23.04.2021 23:20

Mathematics, 23.04.2021 23:20