Mathematics, 15.07.2020 21:01 ayshearouse1203

Drew sold his house for $99,000 and had $9,000 in closing costs. His beginning basis was $45,000 and he spent $14,000 on capital improvements. What is Drew's capital gain for tax purposes? Drew does not qualify for an exclusion.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:00

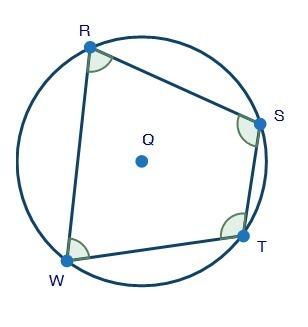

In a circle, a 45° sector has an area of 32π cm2. what is the radius of this circle? 32 cm 12 cm 16 cm 8 cm

Answers: 3

Mathematics, 22.06.2019 03:30

The monthly texting plan of all star cell is $11 per month and $0.25 per text. the monthly texting plan of top line cell is $14 per month and $0.15 per text. a student wants to set up a system of equations to find the number of texts for which the total monthly cost of the two companies is the same. he uses the variables x and y. he lets y represent the total monthly cost. what will x represent? x = number of texts x = cost of the total number of texts x = total monthly cost x = cost of each text

Answers: 1

You know the right answer?

Drew sold his house for $99,000 and had $9,000 in closing costs. His beginning basis was $45,000 and...

Questions

Mathematics, 22.08.2019 08:50

Mathematics, 22.08.2019 08:50

English, 22.08.2019 08:50

History, 22.08.2019 08:50

Physics, 22.08.2019 08:50

Social Studies, 22.08.2019 08:50

Computers and Technology, 22.08.2019 08:50

Mathematics, 22.08.2019 08:50

Social Studies, 22.08.2019 08:50