Mathematics, 07.07.2020 23:01 bbenaventbbbb9653

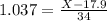

The Capital Asset Pricing Model (CAPM) is a financial model that assumes returns on a portfolio are normally distributed. Suppose a portfolio has an average annual return of 17.9% (i. e., an average gain of 17.9%) with a standard deviation of 34%. A return of 0% means the value of the portfolio doesn't change, a negative return means that the portfolio loses money, and a positive return means that the portfolio gains money. (Round your answers to two decimal places.)a.) What percent of years does this portfolio lose money, i. e. have a return less than 0%? b.) What is the cutoff for the highest 15% of annual returns with this portfolio?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:40

Lines a and b are parallel. what is the value of x? -5 -10 -35 -55

Answers: 2

Mathematics, 21.06.2019 21:00

The area of a rectangle is 10 cm^2. one side of the rectangle is x cm. express the perimeter of the rectangle in terms of x and show that this rectangle cannot have a perimeter of 12 cm. the perimeter of the rectangle in terms of x is __ cm

Answers: 1

Mathematics, 21.06.2019 22:10

Aculture started with 2,000 bacteria. after 8 hours, it grew to 2,400 bacteria. predict how many bacteria will be present after 19 hours . round your answer to the nearest whole number. p=ae^kt

Answers: 1

Mathematics, 21.06.2019 23:30

Drag each equation to the correct location on the table. for each equation, determine the number of solutions and place on the appropriate field in the table.

Answers: 3

You know the right answer?

The Capital Asset Pricing Model (CAPM) is a financial model that assumes returns on a portfolio are...

Questions

Biology, 27.07.2019 04:30

Chemistry, 27.07.2019 04:30

Mathematics, 27.07.2019 04:30

Biology, 27.07.2019 04:30

Health, 27.07.2019 04:30

Social Studies, 27.07.2019 04:30

Advanced Placement (AP), 27.07.2019 04:30

Mathematics, 27.07.2019 04:30

and standard deviation

and standard deviation  , the zscore of a measure X is given by:

, the zscore of a measure X is given by: