Mathematics, 05.07.2020 16:01 pr47723

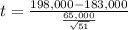

According to the New York Stock Exchange, the mean portfolio value for U. S. senior citizens who are shareholders is $183,000. Assume portfolio values are normally distributed. Suppose a simple random sample of 51 senior citizen shareholders in a certain region of the United States is found to have a mean portfolio value of $198,000, with a standard deviation of $65,000.

a. From these sample results, and using the 0.05 level of significance comment on whether the mean portfolio value for all senior citizen shareholders in this region might not be the same as the mean value reported for their counterparts across the nation, by using the critical value method. Establish the null and alternative hypotheses.

b. What is your conclusion about the null hypothesis?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 22:10

2. using calculations based on a perpetual inventory system, determine the inventory balance altira would report in its august 31, 2021, balance sheet and the cost of goods sold it would report in its august 2021 income statement using the average cost method. (round "average cost per unit" to 2 decimal places.)

Answers: 1

Mathematics, 21.06.2019 23:30

Write the percent as a fraction or mixed number in simplest form. 0.8%

Answers: 2

Mathematics, 21.06.2019 23:40

Typically a point in a three dimensional cartesian coordinate system is represented by which of the following answers in the picture !

Answers: 1

Mathematics, 22.06.2019 00:20

Abag contains pieces of paper numbered from 5 to 9. a piece of paper is drawn at random. what is the theoretical probability of drawing a number less than 8?

Answers: 1

You know the right answer?

According to the New York Stock Exchange, the mean portfolio value for U. S. senior citizens who are...

Questions

Mathematics, 21.04.2021 22:20

Mathematics, 21.04.2021 22:20

Chemistry, 21.04.2021 22:20

Mathematics, 21.04.2021 22:20

Biology, 21.04.2021 22:20

Mathematics, 21.04.2021 22:20

Mathematics, 21.04.2021 22:20

Mathematics, 21.04.2021 22:20

Mathematics, 21.04.2021 22:20