Mathematics, 21.06.2020 16:57 marelinatalia2000

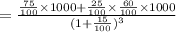

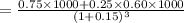

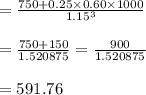

A corporate bond has a coupon rate of 5.5 percent, a $1,000 face value, and matures three years from today. The corporation is in a serious financial situation and has announced that no future annual interest payments will be paid and that the probability the entire face value will be repaid is only 75 percent. If the entire face value cannot be paid, then 60 percent of the face value will be repaid. All payments will be made three years from now. What is the current value of this bond at a discount rate of 15 percent?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:30

What is the value of x in the following equation? -3x-2=2x+8

Answers: 1

Mathematics, 21.06.2019 23:00

Hormones perform important functions within the reproductive system. during puberty, a number of changes occur in the body. which hormone is responsible for the development of these characteristics in the female? estrogen progestin progesterone testosterone

Answers: 1

Mathematics, 22.06.2019 01:20

Determine the vertex form of g(x) = x2 + 2x - 1. which graph represents g(x)? -nw -3-2-1, 1 1 2 3 -3 2- 1 -3- 1 2 3 - 1 2 3

Answers: 1

You know the right answer?

A corporate bond has a coupon rate of 5.5 percent, a $1,000 face value, and matures three years from...

Questions

Mathematics, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40

Business, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40

English, 19.02.2021 22:40

English, 19.02.2021 22:40

History, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40

Mathematics, 19.02.2021 22:40