Mathematics, 17.06.2020 22:57 lilkassrocks

Do bonds reduce the overall risk of an investment portfolio? Let x be a random variable representing annual percent return for Vanguard Total Stock Index (all stocks). Let y be a random variable representing annual return for Vanguard Balanced Index (60% stock and 40% bond). For the past several years, we have the following data.

x: 17 0 17 28 28 27 29 −12 −12 −13

y: 14 −2 27 18 20 11 14 −2 −3 −10

A) Compute ∑x, ∑x2, ∑y, ∑y2

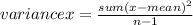

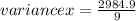

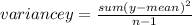

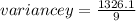

B) Use the results of part (a) to compute the sample mean, variance, and standard

deviation for x and for y.

C) Compute a 75% Chebyshev interval around the mean for x values and also for

y values. Use the intervals to compare the two funds.

D) Compute the coefficient of variation for each fund. Use the coefficients of variation

to compare the two funds. If s represents risks and image from custom entry tool represents expected return, then image from custom entry tool can be thought of as a measure of risk per unit of expected return. In this case, why is a smaller CV better? Explain.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Write an equation in slope intercept form of the line passes through the given point and is parallel to the graph of the given equation (0,0); y=3/8 x+2

Answers: 1

Mathematics, 21.06.2019 18:30

Can someone check if i did this right since i really want to make sure it’s correct. if you do you so much

Answers: 1

Mathematics, 21.06.2019 21:00

Two florida panthers were weighed. one weighs 6x+21 pounds and the two together weigh 14x+11 pounds how much does he other panther weigh alone

Answers: 1

Mathematics, 22.06.2019 00:20

How is this equation completed? i cannot find any examples in the book.

Answers: 1

You know the right answer?

Do bonds reduce the overall risk of an investment portfolio? Let x be a random variable representing...

Questions

Chemistry, 06.01.2021 02:30

Physics, 06.01.2021 02:30

Mathematics, 06.01.2021 02:30

Mathematics, 06.01.2021 02:30

Mathematics, 06.01.2021 02:30

Mathematics, 06.01.2021 02:30

Social Studies, 06.01.2021 02:30

English, 06.01.2021 02:30

Geography, 06.01.2021 02:30