Mathematics, 17.06.2020 09:57 fordd4

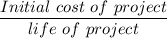

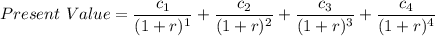

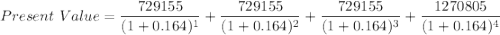

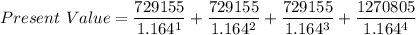

A company is planning a four-year project, with an initial cost of $1.67 million. This investment cost is amortised to zero over four years on a straight-line basis. However, the asset could be disposed of for $435,000 in four years. The project requires $198,000 in working capital initially and is fully recoverable after the project is completed. The project generates $1,850,000 in sales and $1,038,000 in costs each year. If the tax rate is 21% and the required return rate is 16.4%, what is NPV?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

The function v(r)=4/3pir^3 can be used to find the volume of air inside a basketball given its radius. what does v(r) represent

Answers: 1

Mathematics, 21.06.2019 23:00

What is the length of the midsegment of a trapezoid with bases of length 15 and 25 ?

Answers: 1

Mathematics, 22.06.2019 01:20

Ahyperbola centered at the origin has a vertex at (-6,0) and a focus at (10,0)

Answers: 2

You know the right answer?

A company is planning a four-year project, with an initial cost of $1.67 million. This investment co...

Questions

Mathematics, 06.10.2020 17:01

Mathematics, 06.10.2020 17:01

Physics, 06.10.2020 17:01

Mathematics, 06.10.2020 17:01

Mathematics, 06.10.2020 17:01