Mathematics, 03.06.2020 18:58 KallMeh

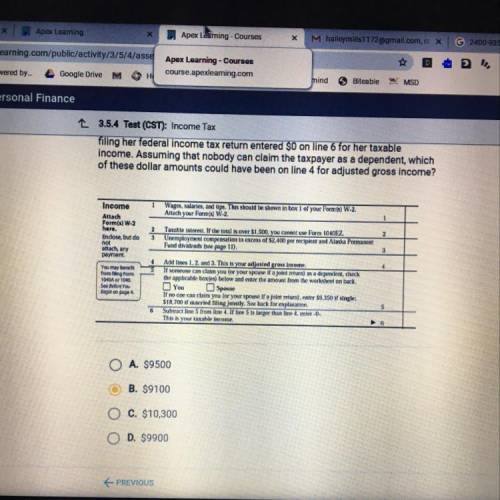

In the Income section shown below from the 1040EZ form, a single taxpayer

filing her federal income tax return entered $0 on line 6 for her taxable

income. Assuming that nobody can claim the taxpayer as a dependent, which

of these dollar amounts could have been on line 4 for adjusted gross income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:30

What is the remainder when 2872 is divided by 76? a) 51 b) 57 c) 60 d) 63

Answers: 2

Mathematics, 21.06.2019 21:00

Oliver read for 450 minutes this month his goal was to read for 10% more minutes next month if all of her medicine go how many minutes will you read all during the next two months

Answers: 3

Mathematics, 21.06.2019 21:30

Consider a bag that contains 220 coins of which 6 are rare indian pennies. for the given pair of events a and b, complete parts (a) and (b) below. a: when one of the 220 coins is randomly selected, it is one of the 6 indian pennies. b: when another one of the 220 coins is randomly selected (with replacement), it is also one of the 6 indian pennies. a. determine whether events a and b are independent or dependent. b. find p(a and b), the probability that events a and b both occur.

Answers: 2

Mathematics, 21.06.2019 22:30

Need same math paper but the back now i hope your able to read it cleary i need with hw

Answers: 1

You know the right answer?

In the Income section shown below from the 1040EZ form, a single taxpayer

filing her federal income...

Questions

History, 03.12.2020 01:00

Mathematics, 03.12.2020 01:00

Health, 03.12.2020 01:00

Social Studies, 03.12.2020 01:00

Mathematics, 03.12.2020 01:00

Chemistry, 03.12.2020 01:00

Spanish, 03.12.2020 01:00

Physics, 03.12.2020 01:00

Mathematics, 03.12.2020 01:00