Mathematics, 19.05.2020 03:14 hi510hello

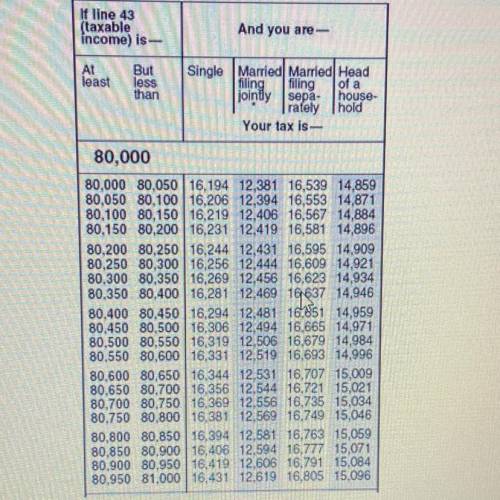

Jarrod's filing status on last year's tax return was Single, while Paige's was

Head of Household. If both had taxable incomes of $80,456, how did the

amounts of taxes they paid compare according to the table below?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

The swimming pool is open when the high temperature is higher than 20∘c. lainey tried to swim on monday and thursday (which was 3 days later). the pool was open on monday, but it was closed on thursday. the high temperature was 30∘c on monday, but decreased at a constant rate in the next 3 days. write an inequality to determine the rate of temperature decrease in degrees celsius per day, d, from monday to thursday.

Answers: 1

Mathematics, 21.06.2019 19:00

15 points! write the slope-intercept form of the equation of the line through the given point with the given slope. use y-y = m(x-x) to solve. through (2,5) slope= undefined

Answers: 2

Mathematics, 21.06.2019 20:10

The population of a small rural town in the year 2006 was 2,459. the population can be modeled by the function below, where f(x residents and t is the number of years elapsed since 2006. f(t) = 2,459(0.92)

Answers: 1

You know the right answer?

Jarrod's filing status on last year's tax return was Single, while Paige's was

Head of Househo...

Head of Househo...

Questions

Mathematics, 10.03.2021 20:00

Mathematics, 10.03.2021 20:00

Mathematics, 10.03.2021 20:00

Mathematics, 10.03.2021 20:00

Mathematics, 10.03.2021 20:00

Mathematics, 10.03.2021 20:00

Mathematics, 10.03.2021 20:00

Spanish, 10.03.2021 20:00

Physics, 10.03.2021 20:00