Mathematics, 05.05.2020 03:12 marvin07

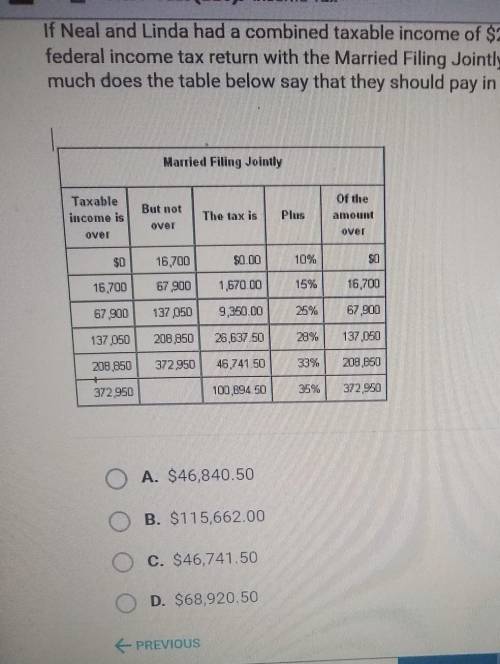

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax with the married filing jointly status , how much does the table below say that they should pay in federal income tax?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 12:30

Convert 16 yards to feet use the conversion rate 3 feet = 1 yard

Answers: 2

Mathematics, 21.06.2019 18:30

Atriangle with all sides of equal length is a/an triangle. a. right b. scalene c. equilateral d. isosceles

Answers: 2

Mathematics, 21.06.2019 21:30

Tom can paint the fence in 12 hours, but if he works together with a friend they can finish the job in 8 hours. how long would it take for his friend to paint this fence alone?

Answers: 1

Mathematics, 22.06.2019 00:00

Jonathan puts $400 in a bank account. each year the account earns 6% simple interest. how much interest will be earned in 5 years?

Answers: 1

You know the right answer?

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax with...

Questions

English, 10.05.2021 20:50

Physics, 10.05.2021 20:50

Mathematics, 10.05.2021 20:50

Social Studies, 10.05.2021 20:50

Chemistry, 10.05.2021 20:50