Mathematics, 30.03.2020 17:20 janeou17xn

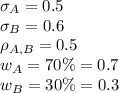

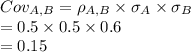

Stock A ‘s returns have a standard deviation of 0.5, and stock B’s returns have standard deviation of 0.6.The correlation coefficient between A and B equals 0.5. What is the variance of a portfolio composed of 70 percent Stock A and 30 percent Stock B?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 13:30

Volume of a cylinder with a radius of 13 in and height of 30 in

Answers: 1

Mathematics, 21.06.2019 18:40

Juliana says that she can use the patterns of equivalent ratios in the multiplication table below to write an infinite number of ratios that are equivalent to 6: 10. which statement explains whether juliana is correct? she is correct because she can multiply 6 and 10 by any number to form an equivalent ratio. she is correct because 6: 10 can be written as 1: 2 and there are an infinite number of ratios for 1: 2. she is not correct because the multiplication table does not include multiples of 10. she is not correct because 6: 10 is equivalent to 3: 5 and there are only 9 ratios in the multiplication table that are equivalent to 3: 5.

Answers: 1

Mathematics, 21.06.2019 19:00

The quadratic function h(t)=-16.1t^2+150 choose the graph representation

Answers: 1

Mathematics, 21.06.2019 20:50

A. what is the area of the base? use complete sentences to explain your reasoning. b. what is the volume of the prism? use complete sentences to explain your reasoning.

Answers: 1

You know the right answer?

Stock A ‘s returns have a standard deviation of 0.5, and stock B’s returns have standard deviation o...

Questions

Mathematics, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00

Biology, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00

History, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00

Mathematics, 10.09.2021 02:00