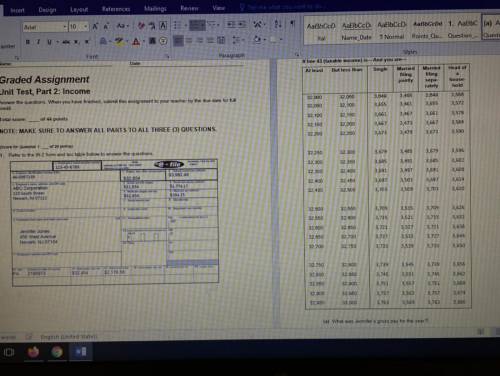

(a) What was Jennifer's gross pay for the year?

(b) How much did she pay in federal income tax...

Mathematics, 26.03.2020 23:34 nehemiahj85

(a) What was Jennifer's gross pay for the year?

(b) How much did she pay in federal income tax?

(c) The amount in Box 4 is incorrect. What dollar amount should have been entered in Box 4?

(d) The amount in Box 6 is incorrect. What dollar amount should have been entered in Box 6?

(e) How much was Jennifer's FICA tax (using the corrected values from (C) and (d))?

(f) Jennifer's taxable income was $32,854. She's filing her taxes as single. Does she owe the

government more money in taxes, or will she receive a refund? How much money will she owe or

receive? Explain.

Answers: 2

Answer from: Quest

Igot 108 hope that’s right !

Answer from: Quest

7

step-by-step explanation:

the answer would be 7

Another question on Mathematics

Mathematics, 21.06.2019 19:00

You earn a 12% commission for every car you sell. how much is your commission if you sell a $23,000 car?

Answers: 1

Mathematics, 21.06.2019 19:40

Afactory makes propeller drive shafts for ships. a quality assurance engineer at the factory needs to estimate the true mean length of the shafts. she randomly selects four drive shafts made at the factory, measures their lengths, and finds their sample mean to be 1000 mm. the lengths are known to follow a normal distribution whose standard deviation is 2 mm. calculate a 95% confidence interval for the true mean length of the shafts. input your answers for the margin of error, lower bound, and upper bound.

Answers: 3

Mathematics, 21.06.2019 20:30

If there is 20 dogs in the shelter and 5 dogs get homes, and then 43 more dogs come. how many dogs are there in the shelter?

Answers: 1

Mathematics, 21.06.2019 20:30

What is the best approximation for the area of a circle with a radius of 4 m ? use 3.14 to approximate pi

Answers: 1

You know the right answer?

Questions

Chemistry, 16.05.2021 17:40

Chemistry, 16.05.2021 17:40

Arts, 16.05.2021 17:40

Mathematics, 16.05.2021 17:40

Mathematics, 16.05.2021 17:40

Mathematics, 16.05.2021 17:40

Mathematics, 16.05.2021 17:40

Computers and Technology, 16.05.2021 17:40

History, 16.05.2021 17:40

Mathematics, 16.05.2021 17:40

Computers and Technology, 16.05.2021 17:40