Mathematics, 19.03.2020 02:28 jacks0292

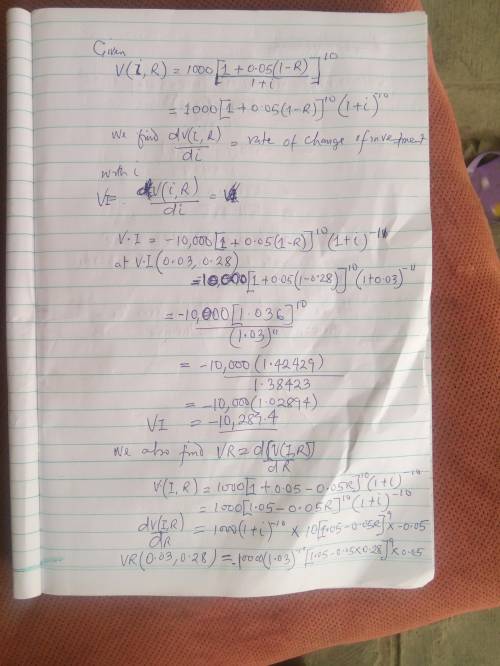

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R) 1 + I^10 where I is the annual rate of inflation and R is the tax rate for the person making the investment.

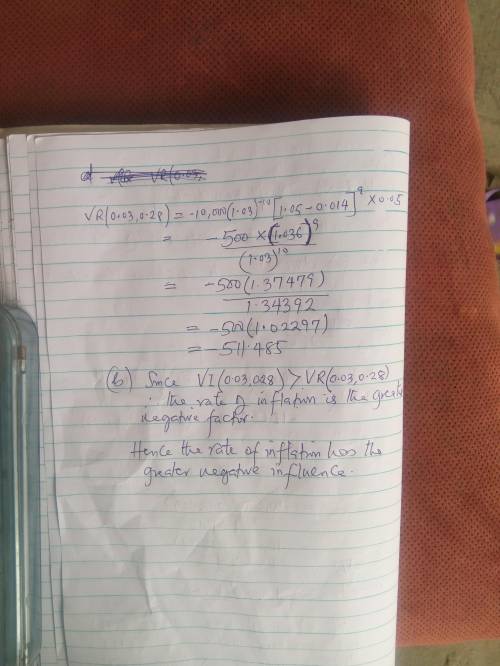

a. Calculate VI(0.03, 0.28) and VR(0.03, 0.28).

b. Determine whether the tax rate or the rate of inflation is the greater "negative" factor in the growth of the investment.

i. The rate of inflation has the greater negative influence.

ii. The tax rate has the greater negative influence

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:20

The graph below shows the height of a projectile t seconds after it is launched. if acceleration due to gravity is -16 ft/s2, which equation models the height of the projectile correctly?

Answers: 2

Mathematics, 21.06.2019 22:00

Aschool had an election where the candidates received votes in the ratio 1: 2: 3. if the winning candidate received 210 votes, how many total people voted in the election?

Answers: 1

You know the right answer?

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R)...

Questions

Biology, 19.02.2021 22:00

Mathematics, 19.02.2021 22:00

French, 19.02.2021 22:00

Physics, 19.02.2021 22:00

Chemistry, 19.02.2021 22:00

Mathematics, 19.02.2021 22:00

Social Studies, 19.02.2021 22:00

Mathematics, 19.02.2021 22:00

Mathematics, 19.02.2021 22:00

Mathematics, 19.02.2021 22:00

Mathematics, 19.02.2021 22:00

English, 19.02.2021 22:00