Mathematics, 06.03.2020 05:54 g0606997

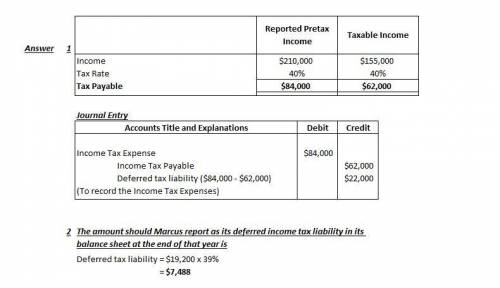

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800. However, because of a temporary difference in the amount of $19,200 relating to depreciation, taxable income is only $255,600. The tax rate is 39%. What amount should Marcus report as its deferred income tax liability in its balance sheet at the end of that year

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:00

If olu is twice as old as funmi if the sum of their ages is 60 how old is olu

Answers: 1

Mathematics, 21.06.2019 21:00

If u good at math hit me up on insta or sum @basic_jaiden or @ and

Answers: 1

Mathematics, 21.06.2019 22:30

What would be the reasons for lines 3 and 4? a. addition property; subtraction property b. addition property; solve c. substitution property; subtraction property d. substitution property; prove

Answers: 1

Mathematics, 22.06.2019 01:00

Y= x – 6 x = –4 what is the solution to the system of equations? (–8, –4) (–4, –8) (–4, 4) (4, –4)

Answers: 1

You know the right answer?

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800....

Questions

Social Studies, 27.11.2021 17:10

Mathematics, 27.11.2021 17:10

English, 27.11.2021 17:10

Arts, 27.11.2021 17:10

English, 27.11.2021 17:10

Social Studies, 27.11.2021 17:10

Mathematics, 27.11.2021 17:10

Mathematics, 27.11.2021 17:10

Mathematics, 27.11.2021 17:10

Mathematics, 27.11.2021 17:10

Mathematics, 27.11.2021 17:20