Mathematics, 28.02.2020 23:28 oreoassassin38

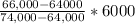

Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for the 2019 calendar tax year. Karen is covered by a pension through her employer. AGI phase-out range for traditional IRA contributions for a single taxpayer who is an active plan participant is $64,000 – $74,000. a. What is the maximum amount that Karen may deduct for contributions to her traditional IRA for 2019?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

You are a clerk at convenience store. a customer owes 11.69 for a bag of potatoes chips. she gives you a five dollar bill. how much change should the customer receive?

Answers: 1

Mathematics, 21.06.2019 18:00

Liz is shipping a package to her friend.the maximum weight of a medium flat-rate box is 20 pounds,including the box which weighs 6 ounces.write and solve an inequality to describe the possible weight ,w, of the contents that liz will ship to her friend if she must use a medium flat-rate box.

Answers: 2

Mathematics, 21.06.2019 18:40

Acircle has a circumference of 28.36 units what is the diameter of the circle

Answers: 2

Mathematics, 21.06.2019 19:30

Show your workcan a right triangle have this sides? *how to prove it without using the pythagorean theorema*

Answers: 2

You know the right answer?

Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for...

Questions

Mathematics, 26.10.2020 17:30

Biology, 26.10.2020 17:30

Chemistry, 26.10.2020 17:30

Biology, 26.10.2020 17:30