Mathematics, 12.02.2020 01:33 andrew194

Problem 2: Calculation of Contingent Options: Let S1 be a random variable that takes on the value of SPY one year from now and let S2 take on the values of SPY 6 months from now. Assume that they are jointly normally distributed with σ1 = 20% σ2 = 15% rho = 0.95 By rho here we mean correlation between S1 and S2. Also, assume that interest rate is zero.

1. Evaluate the price of the one year call on SPY with the strike K1 = 260. This is an example of a vanilla option.

2. Evaluate the price of the one year call on SPY with the strike K1 = 260, contingent on SPY at 6 months being below 250. This is a contingent option.

3. Calculate the contingent option again, but with rho = 0.8, rho = 0.5, and rho = 0.2.

4. Does dependence on rho make sense?

5. Calculate the contingent option again, but with SPY at 6 months below 240, 230, and 220.

6. Does the dependence on the 6 month value make sense?

7. Under what conditions do you think the price of the contingent option will equal the price of the vanilla one?

Answers: 3

Another question on Mathematics

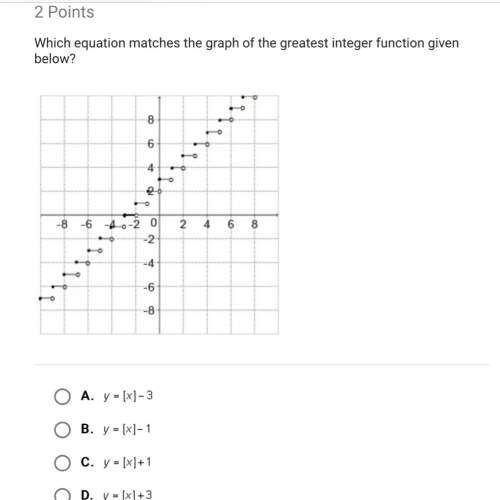

Mathematics, 21.06.2019 15:30

Look at the following graph of the given equation. determine whether the equation is a function. explain why or why not.

Answers: 1

Mathematics, 21.06.2019 18:30

Can someone me do math because i am having a breakdown rn because i don’t get it

Answers: 1

You know the right answer?

Problem 2: Calculation of Contingent Options: Let S1 be a random variable that takes on the value of...

Questions

Mathematics, 27.01.2020 22:31

Biology, 27.01.2020 22:31

Mathematics, 27.01.2020 22:31

Chemistry, 27.01.2020 22:31

Chemistry, 27.01.2020 22:31

Health, 27.01.2020 22:31

Mathematics, 27.01.2020 22:31

Business, 27.01.2020 22:31

Mathematics, 27.01.2020 22:31

History, 27.01.2020 22:31

Chemistry, 27.01.2020 22:31