Mathematics, 18.01.2020 13:31 Nicolegrove7927

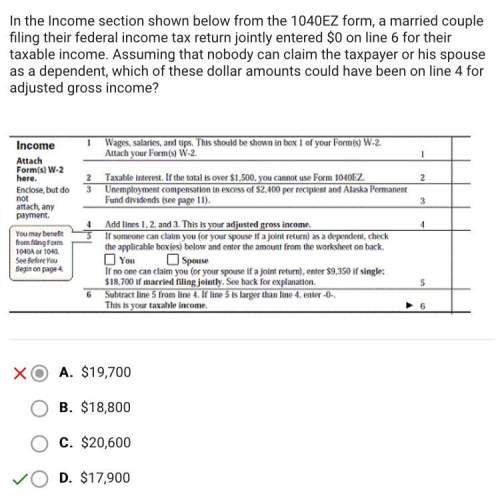

In the income section shown below from the 1040ez form, a married couple filing their federal income tax return jointly entered $0 on line 6 for their taxable income. assuming that nobody can claim the taxpayer or his spouse as a dependent, which of these dollar amounts could have been on line 4 for adjusted gross income?

$17,900

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:30

What is the area of a pizza with a radius of 40 cm leave the answer in terms of π to find your exact answer 40π cm² 1600π cm² 800π cm² 80π cm² π=pi

Answers: 1

Mathematics, 21.06.2019 18:30

Alicia puts $400 in a bank account. each year the account earns 5% simple interest. how much money will be in her bank account in six months?

Answers: 1

Mathematics, 21.06.2019 19:00

The fraction 7/9 is equivalent to a percent that is greater than 100%. truefalse

Answers: 1

Mathematics, 21.06.2019 21:50

Scores on a university exam are normally distributed with a mean of 78 and a standard deviation of 8. the professor teaching the class declares that a score of 70 or higher is required for a grade of at least “c.” using the 68-95-99.7 rule, what percentage of students failed to earn a grade of at least “c”?

Answers: 1

You know the right answer?

In the income section shown below from the 1040ez form, a married couple filing their federal income...

Questions

Physics, 16.10.2020 16:01

Biology, 16.10.2020 16:01

Mathematics, 16.10.2020 16:01

Physics, 16.10.2020 16:01

Mathematics, 16.10.2020 16:01

Health, 16.10.2020 16:01

History, 16.10.2020 16:01

Mathematics, 16.10.2020 16:01

Mathematics, 16.10.2020 16:01

Mathematics, 16.10.2020 16:01

Chemistry, 16.10.2020 16:01