Data analysis in finance:

suppose you had data on stock price indices in two different countr...

Mathematics, 18.12.2019 23:31 jayjat97

Data analysis in finance:

suppose you had data on stock price indices in two different countries. you are interested in causality issues and want to find out whether movements in stock prices in one country effect stock prices in another. describe all the steps you would go through (i. e. what models you would estimate and what testing procedures you would use) to investigate your question of interest.

a. test for stationarity each series x and y

b. if x and y are nonstationary test for cointeration. regress y on x and c and test whether the residual is stationary. if the residual e=y-c-bx is stationary there is cointegrating relationship between x and y.

c. estimate var or vecm depending on whether you found nonstationarity and cointegration. if y and x are stationary use x and y in var. if y and x nonstationary and not cointegrated use var for ? y and ? x. if you found cointegration use vecm. use cointegrating term e(t-1), ? y and ? x in vecm. stationary you use var. d. test for granger casuality. the coefficients of lagged variables x in equation for y should be tested for significance in order to find out whether x granger causes y and vice versa.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:40

Neoli is a nurse who works each day from 8: 00 am to 4: 00 pm at the blood collection centre. she takes 45 minutes for her lunch break. on average, it takes neoli 15 minutes to collect each sample and record the patient's details. on average, how many patients can neoli see each day?

Answers: 3

Mathematics, 21.06.2019 19:40

The owners of four companies competing for a contract are shown in the table below. if a report is released that advocates company b, which of the people having funded the report should result in the most skepticism? company owner of company company a jake adams company b company c company d debby smith henry rose rhonda baker o a. jake adams o b. rhonda baker o c. debby smith o d. henry rose

Answers: 2

Mathematics, 21.06.2019 22:30

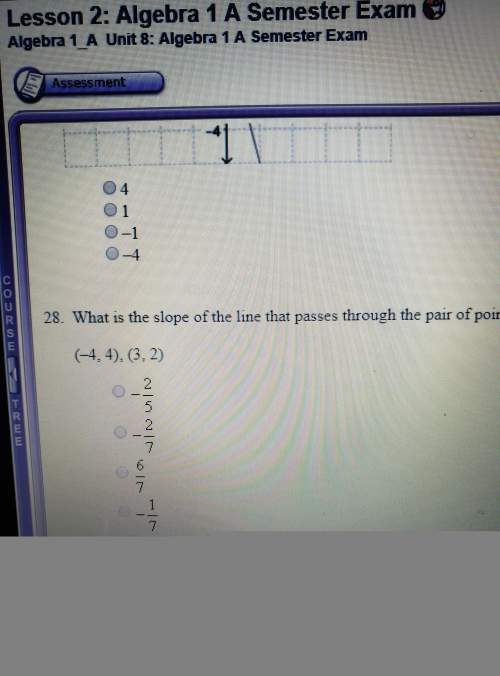

One number is 4 less than 3 times a second number. if 3 more than two times the first number is decreased by 2 times the second number, the result is 11. use the substitution method. what is the first number?

Answers: 1

Mathematics, 22.06.2019 00:30

Given sin28.4=.4756, cos28.4=.8796, and tan28.4=.5407 find the cot of 61.6

Answers: 1

You know the right answer?

Questions

Business, 25.09.2019 05:00

Health, 25.09.2019 05:00

Mathematics, 25.09.2019 05:00

Mathematics, 25.09.2019 05:00

Mathematics, 25.09.2019 05:00

Mathematics, 25.09.2019 05:00

Biology, 25.09.2019 05:00

History, 25.09.2019 05:00

Biology, 25.09.2019 05:00

Chemistry, 25.09.2019 05:00