Mathematics, 26.11.2019 21:31 JayJaYMoney251

Morales publishing's tax rate is 40%, its beta is 1.10, and it uses no debt. however, the cfo is considering moving to a capital structure with 30% debt and 70% equity. if the risk-free rate is 5.0% and the market risk premium is 6.0%, by how much would the capital structure shift change the firm's cost of equity?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Which of the following of the following sets of side lengths could not form a triangle?

Answers: 3

Mathematics, 21.06.2019 16:00

The scatter plot graph shows the average annual income for a certain profession based on the number of years of experience which of the following is most likely to be the equation of the trend line for this set of data? a. i=5350e +37100 b. i=5350e-37100 c. i=5350e d. e=5350e+37100

Answers: 1

Mathematics, 21.06.2019 16:30

Mexico city, mexico, is the world's second largest metropolis and is also one of its fastest-growing cities with a projected growth rate of 3.2% per year. its population in 1991 was 20,899,000 people. use the formula p = 20.899e0.032t to predict its population p in millions with t equal to the number of years after 1991. what is the predicted population to the nearest thousand of mexico city for the year 2010?

Answers: 2

Mathematics, 21.06.2019 20:00

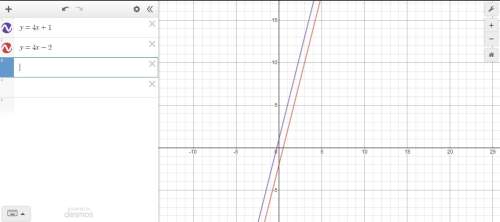

Find the slope of the line passing through a pair of points

Answers: 2

You know the right answer?

Morales publishing's tax rate is 40%, its beta is 1.10, and it uses no debt. however, the cfo is con...

Questions

English, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Chemistry, 05.02.2021 03:00

English, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

History, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00

Mathematics, 05.02.2021 03:00