Mathematics, 24.10.2019 02:50 rachelsweeney10

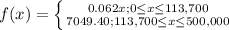

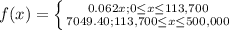

If you earned up to $113,700 in 2013 from an employer, your social security tax rate was 6.2% of your income. if

you earned over $113,700, you paid a fixed amount of $7,049.40.

a. write a piecewise linear function to represent the 2013 social security taxes for incomes between $0 and

$500,000.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:30

The amount of money, in dollars, in an account after t years is given by a = 1000(1.03)^t. the initial deposit into the account was $_^a0 and the interest rate was _a1% per year. only enter numbers in the boxes. do not include any commas or decimal points^t. the initial deposit into the account was $__^a0 and the interest rate is % per year.

Answers: 2

Mathematics, 21.06.2019 19:00

Lena reflected this figure across the x-axis. she writes the vertices of the image as a'(−2, 8), b'(−5, 6), c'(−8, 8), d'(−4, 2).

Answers: 2

Mathematics, 21.06.2019 21:00

What is the value of m in the equation 1/2 m - 3/4n=16 when n=8

Answers: 1

Mathematics, 21.06.2019 23:40

Cos^2x+cos^2(120°+x)+cos^2(120°-x)i need this asap. pls me

Answers: 1

You know the right answer?

If you earned up to $113,700 in 2013 from an employer, your social security tax rate was 6.2% of you...

Questions

Arts, 20.09.2020 09:01

Law, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

Physics, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

Social Studies, 20.09.2020 09:01

Medicine, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013