Mathematics, 27.09.2019 03:00 Ericapab

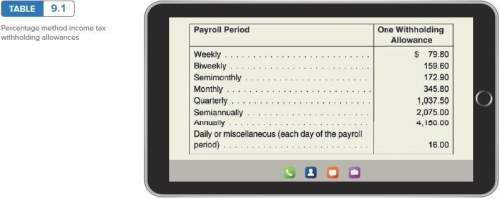

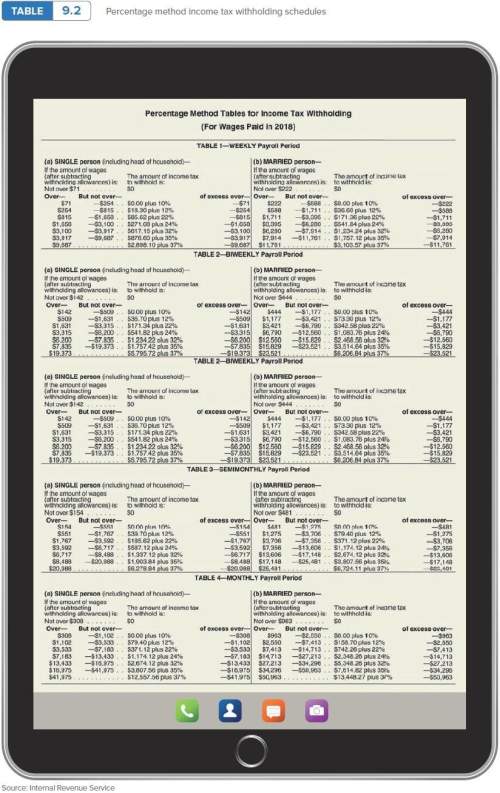

Calculate social security taxes, medicare taxes, and fit for jordon barrett. he earns a monthly salary of $13,400. he is single and claims 1 deduction. before this payroll, barrett’s cumulative earnings were $128,120. (social security maximum is 6.2% on $128,400 and medicare is 1.45%.) calculate fit by the percentage method.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Parks is wearing several rubber bracelets one third of the bracelets are tie-dye 1/6 are blue and 1/3 of the remainder are camouflage if parks wears 2 camouflage bracelets how many bracelets does he have on

Answers: 2

Mathematics, 21.06.2019 18:30

If, while training for a marathon, you ran 60 miles in 2/3 months, how many miles did you run each month? (assume you ran the same amount each month) write your answer as a whole number, proper fraction, or mixed number in simplest form. you ran __ miles each month.

Answers: 1

Mathematics, 21.06.2019 21:00

To finance her community college education, sarah takes out a loan for $2900. after a year sarah decides to pay off the interest, which is 4% of $2900. how much will she pay

Answers: 1

Mathematics, 21.06.2019 22:30

Which of the following represents the length of a diagonal of this trapezoid?

Answers: 1

You know the right answer?

Calculate social security taxes, medicare taxes, and fit for jordon barrett. he earns a monthly sala...

Questions

World Languages, 22.04.2020 06:18

Mathematics, 22.04.2020 06:18

Biology, 22.04.2020 06:18

Mathematics, 22.04.2020 06:18

Geography, 22.04.2020 06:18

Law, 22.04.2020 06:18

History, 22.04.2020 06:18

Mathematics, 22.04.2020 06:18

Biology, 22.04.2020 06:18