Mathematics, 23.09.2019 23:00 joejonaslover7476

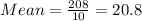

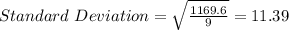

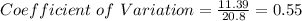

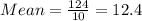

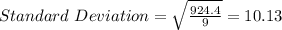

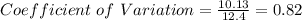

Do bonds reduce the overall risk of an investment portfolio? let x be a random variable representing annual percent return for the vanguard total stock index (all stocks). let y be a random variable representing annual return for the vanguard balanced index (60% stock and 40% bond). for the past several years, assume the following data. x: 14 0 39 25 32 27 28 14 14 15 y: 6 2 29 17 26 17 17 2 3 5 compute the coefficient of variation for each fund. round your answers to the nearest tenth.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 12:50

Suppose the probability of selling a car today is 0.28. find the odds against selling a car today.

Answers: 3

Mathematics, 21.06.2019 19:30

Factor the expression using the gcf. the expression 21m−49n factored using the gcf

Answers: 2

Mathematics, 21.06.2019 23:30

The legs of a right triangle measure 6 meters and 8 meters. what is the length of the hypotonuse.

Answers: 1

You know the right answer?

Do bonds reduce the overall risk of an investment portfolio? let x be a random variable representin...

Questions

Mathematics, 05.12.2019 18:31

History, 05.12.2019 18:31

Mathematics, 05.12.2019 18:31

English, 05.12.2019 18:31

History, 05.12.2019 18:31

Mathematics, 05.12.2019 18:31

Mathematics, 05.12.2019 18:31

World Languages, 05.12.2019 18:31

Mathematics, 05.12.2019 18:31

Mathematics, 05.12.2019 18:31

Social Studies, 05.12.2019 18:31

Biology, 05.12.2019 18:31

Health, 05.12.2019 18:31

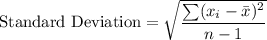

are data points,

are data points,  is the mean and n is the number of observations.

is the mean and n is the number of observations.