Mathematics, 06.09.2019 23:30 davisnaziyahovz5sk

Molly flynn, an accountant at coor company, earned $102,800 from january to october. in november, molly earned $8,500. assume a tax rate of 6.2% for social security on a $110,100.00 base and a medicare tax rate of 1.45%. how much is deducted from molly’s pay for social security and for medicare for the november pay period?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:30

What is the best reason for jacinta to have a savings account in addition to a checking account

Answers: 1

Mathematics, 21.06.2019 16:20

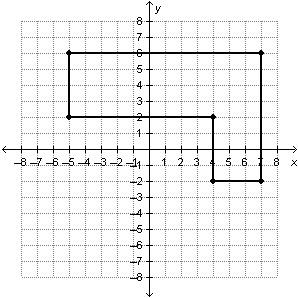

Find the slope of a line given the following two points

Answers: 1

Mathematics, 21.06.2019 18:00

Jose predicted that he would sell 48 umbrellas. he actually sold 72 umbrellas. what are the values of a and b in the table below? round to the nearest tenth if necessary

Answers: 2

You know the right answer?

Molly flynn, an accountant at coor company, earned $102,800 from january to october. in november, mo...

Questions

Mathematics, 20.11.2021 07:00

Social Studies, 20.11.2021 07:00

Mathematics, 20.11.2021 07:00

Computers and Technology, 20.11.2021 07:00

History, 20.11.2021 07:10

History, 20.11.2021 07:10

Mathematics, 20.11.2021 07:10