Mathematics, 25.06.2019 21:00 maritzamartinnez

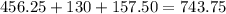

If the home is worth $97,540 and your insurance covers 10 percent of other structures, what is the total amount of coverage? 4877 975 7342 9754 if the home is worth $123,670 and your insurance covers 20 percent of living expenses during repair, what is the total amount of coverage? 4877 9175 17342 24734 if the home is worth $210,400 and your insurance covers 5 percent of other structures, what is the total amount of coverage? 9877 9550 10520 9754 if lauren's home is worth $159,000, and her insurance covers 50 percent for personal property, what is the total amount of coverage? 79500 119250 124550 39750 joan pays $456.25 monthly on her mortgage. if her annual insurance premium is $1,560 and her annual real estate tax is $1,890, what is her combined monthly payment to her mortgage lender? round each answer to the nearest cent before adding. 959.35 240.51 586.25 743.75 janice pays $625.18 monthly on her mortgage. if her annual insurance premium is $2,420 and her annual real estate tax is $1,590, what is her combined monthly payment to her mortgage lender? round each answer to the nearest cent before adding. 959.35 240.51 586.25 743.75 tammy pays $590.36 monthly on her mortgage. if her annual insurance premium is $1,290 and her annual real estate tax is $2,460, what is her combined monthly payment to her mortgage lender? round each answer to the nearest cent before adding. 959.35 902.86 586.25 743.75

Answers: 1

Another question on Mathematics

Mathematics, 22.06.2019 01:30

Josie buys a pair of boots that retail for $52.00 dollars, however they are currently on sale for 25% off how much does josie pay for the boots if there is also a 6% sales tax on them

Answers: 1

Mathematics, 22.06.2019 03:00

Linda and ralph have signed a contract to purchase a home. the closing date is april 27, and the buyer owns the property on the day of closing. the selling price of the home is $782,500. linda and ralph obtained a fixed-rate mortgage from a bank for $685,000 at 7.35% interest. the seller has already paid $14,578.15 in property taxes for the coming year. how much will linda and ralph owe in prorated expenses? (3 points) $64,925.65 $34,347.06 $10,496.82 $9,945.06

Answers: 3

You know the right answer?

If the home is worth $97,540 and your insurance covers 10 percent of other structures, what is the t...

Questions

Mathematics, 22.10.2020 01:01

Biology, 22.10.2020 01:01

Mathematics, 22.10.2020 01:01

Mathematics, 22.10.2020 01:01

Mathematics, 22.10.2020 01:01

Chemistry, 22.10.2020 01:01

Engineering, 22.10.2020 01:01

History, 22.10.2020 01:01

Mathematics, 22.10.2020 01:01

Mathematics, 22.10.2020 01:01

Business, 22.10.2020 01:01

Social Studies, 22.10.2020 01:01

History, 22.10.2020 01:01

Mathematics, 22.10.2020 01:01

= $24734

= $24734 = $10520

= $10520 = $79500

= $79500