Business, 02.08.2019 22:00 jessicap7pg75

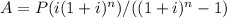

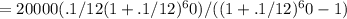

You want to buy a car, and a local bank will lend you $20,000. the loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 10% with interest paid monthly. 1. what will be the monthly loan payment? 2. what will be the loan's ear?

Answers: 1

Another question on Business

Business, 21.06.2019 17:30

Salvador county issued $25 million of 5% demand bonds for construction of a county maintenance building. the county has no take-out agreement related to the bonds. it estimates that 20% of the bonds would be demanded (called) by the buyers if interest rates increased at least 1%. at year-end rates on comparable debt were 7%. how should these demand bonds be reported in the government-wide financial statements at year-end? a) $25 million in the long-term liability section of the governmental activities column. b) $5 million in the current liability section of the governmental activities column and $20 million in the long-term liabilities section of the governmental activities column. c) $5 million in the governmental activities column and $20 million would be reported in the schedule of changes in long-term debt obligations. d) $25 million in the current liability section of the governmental activities column

Answers: 1

Business, 21.06.2019 22:00

Select the correct answers. mila is at a flea market. she has $50 in her wallet. she decides that she will spend $15 on jewelry, $20 on a pair of jeans, $5 on a t-shirt, and $10 on something to eat. she likes a one-of-a-kind t-shirt, but the seller is not ready to sell it for less than $8. she thinks of five ways to deal with this situation. which two choices indicate a trade-off?

Answers: 3

Business, 22.06.2019 00:30

A) plot the m1 and m2 money stock in the us from 1990-2015. (hint: you may use the data tools provided by fred.) (b) plot the nominal interest rate from 1960 to 2014. (hint: you can either use the daily interest rates for selected u.s. treasury, private money market and capital market instruments from or the effective federal funds rate fromfred.) (c) the consumer price index (cpi) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. intuitively, the cpi represents the cost of living or the average price level. plot the cpi from 1960 to 2013.(d) the inflation rate is the yearly percentage change in the average price level. in practice, we usually use the percentage change in the cpi to compute the inflation rate. plot the inflation rate from 1960 to 2013.(e) explain the difference between the ex-ante and ex-post real interest rate. use the fisher equation to compute the ex-post real interest rate. plot the nominal interest rate and the ex-post real interest rate from 1960 to 2013 in the same graph.

Answers: 3

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

You know the right answer?

You want to buy a car, and a local bank will lend you $20,000. the loan will be fully amortized over...

Questions

Mathematics, 22.08.2020 05:01

Mathematics, 22.08.2020 05:01

Mathematics, 22.08.2020 05:01

Mathematics, 22.08.2020 05:01

Mathematics, 22.08.2020 05:01

Mathematics, 22.08.2020 05:01

Social Studies, 22.08.2020 05:01

History, 22.08.2020 05:01

Mathematics, 22.08.2020 05:01

English, 22.08.2020 05:01

to the nearest cent

to the nearest cent