Business, 27.07.2019 17:30 ryansingl19

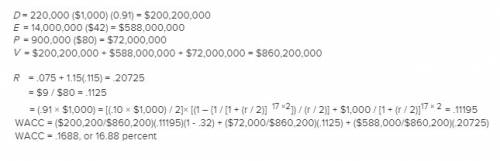

Deep mines has 14 million shares of common stock outstanding with a beta of 1.15 and a market price of $42 a share. there are 900,000 shares of 9 percent preferred stock outstanding valued at $80 a share. the 10 percent semiannual bonds have a face value of $1,000 and are selling at 91 percent of par. there are 220,000 bonds outstanding that mature in 17 years. the market risk premium is 11.5 percent, t-bills are yielding 7.5 percent, and the firm's tax rate is 32 percent. what discount rate should the firm apply to a new project's cash flows if the project has the same risk as the firm's typical project?

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 22.06.2019 21:10

Which of the following statements is (are) true? i. free entry to a perfectly competitive industry results in the industry's firms earning zero economic profit in the long run, except for the most efficient producers, who may earn economic rent. ii. in a perfectly competitive market, long-run equilibrium is characterized by lmc < p < latc. iii. if a competitive industry is in long-run equilibrium, a decrease in demand causes firms to earn negative profit because the market price will fall below average total cost.

Answers: 3

Business, 22.06.2019 21:20

Which of the following best explains why large companies pay less for goods from wholesalers? a. large companies are able to pay for the goods they purchase in cash. b. large companies are able to increase the efficiency of wholesale production. c. large companies can buy all or most of a wholesaler's stock. d. large companies have better-paid employees who are better negotiators.

Answers: 2

You know the right answer?

Deep mines has 14 million shares of common stock outstanding with a beta of 1.15 and a market price...

Questions

Mathematics, 29.01.2021 07:40

History, 29.01.2021 07:40

World Languages, 29.01.2021 07:40

Mathematics, 29.01.2021 07:40

Mathematics, 29.01.2021 07:40

Mathematics, 29.01.2021 07:40

Mathematics, 29.01.2021 07:40